In this latest installment of Mo Co Economy Watch we take a hint from surging infection levels and pause to re-assess the economic risk associated with COVID-19 for Montgomery County and the region.

DÉJÀ VU ALL OVER AGAIN?

Recent news about COVID-19 variants, surging infection rates, breakthrough infections, and the unknowns & geopolitics of “booster shots” got me thinking about economic resiliency. It isn’t likely that 2021 will see shutdowns significantly affecting employment or GDP in the near term – as Fed Chair Jerome Powell said this week “we’ve kind of learned to live with it.” That said, it is likely that the virus will continue to have an impact on the economy, and a lot of the impact will be concentrated in specific industries. As such, I decided to comb through the data for some clues about how much of the economy could be affected if the virus continues on its current trajectory and leads to some combination of more cautious consumer behavior and more restrictive public health measures.

vulnerable industries: THE USUAL SUSPECTS

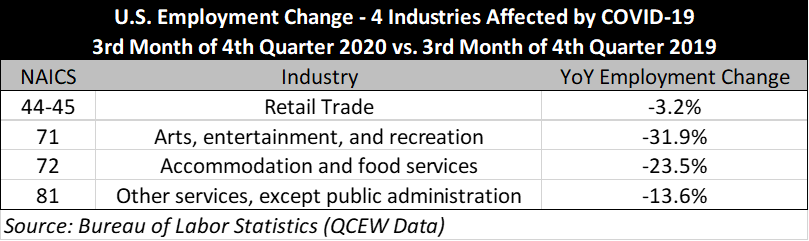

While the economic effects of COVID-19 hit broad swaths of the U.S. economy, the ongoing effects are likely to be most acute in four industries that we are keeping an eye on: retail trade (NAICS 44-45); arts, entertainment, and recreation (NAICS 71); accommodation and food services (NAICS 72); and other services, except public administration (NAICS 81). Together these industries represent 10.6% of U.S. Gross Domestic Product and 26.6% of private sector “covered” employment.

It is possible that other key industries will be significantly impacted, though I do think that some of the supply chain issues that we saw last year (wholesale trade; transportation and warehousing) are unlikely to repeat to the same degree. An influx of federal money has stabilized a lot of public sector budgets for now. And I think that we can generally agree that kids going back to school and patients going back to their doctors are things that can and will happen this year, though the rate or extent of those returns remains to be seen.

The table below illustrates the magnitude of the U.S. employment loss in the 4 key industries from December 2019 to December 2020.

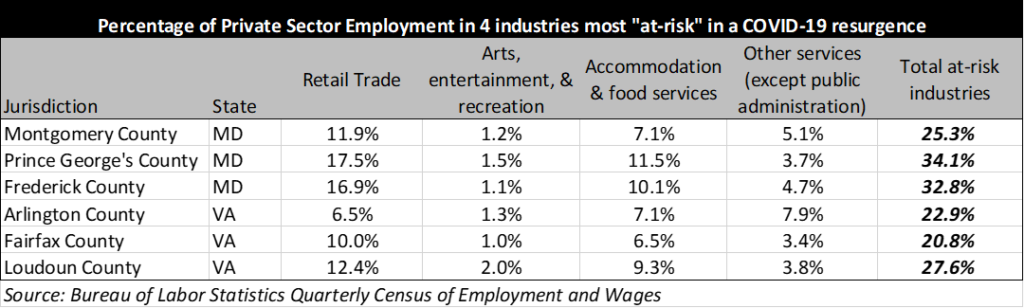

MONTGOMERY COUNTY’S EXPOSURE TO COVID-19 ECONOMIC RISK Montgomery County is in the middle of the pack for employment in the industries that are most “at-risk” when it comes to a resurgence of infections and the public health measures necessary to contain the disease outbreak, based on the 3rd month of the 4th quarter of 2020.

Montgomery County’s neighbors in suburban Maryland are more at-risk, with roughly one-third of their private sector workforces in industries that are highly susceptible to the economic downsides of the disease. This is generally unsurprising given the growth of National Harbor, and given the wide gap (narrowing!) between the total amount of office space in Montgomery County and its Maryland neighbors.

Again, it is worth keeping in mind that the these percentages would be lower across the board (and more so for some jurisdictions than others) if we are including the self-employed, but it is hard for me to wrap my mind around the industry-level impacts on self-employment jurisdiction by jurisdiction (and we’re already using QCEW numbers for our analysis of work-from-home impacts, so we’re going to use QCEW employment numbers here as well).

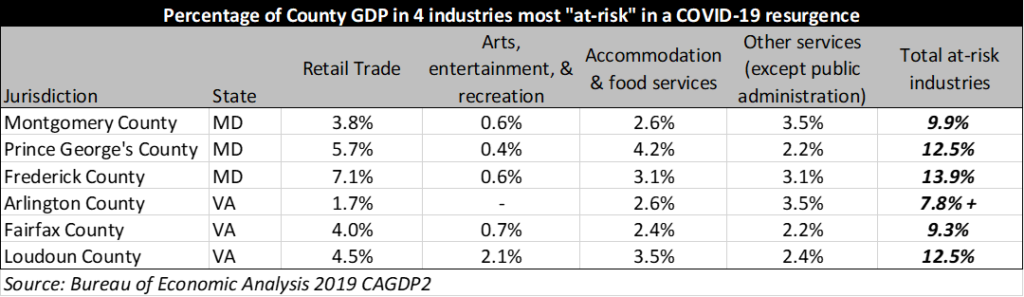

As with employment, GDP numbers indicate that Montgomery County’s economic risk is “middle of the road” when compared to regional suburban peers. Just under 10% of Montgomery County’s value-added output is from the 4 industries that are most economically at-risk in connection with a resurgence of COVID-19.

Employment numbers are not available for arts, entertainment, and recreation in Arlington – the data is suppressed because of the sample size and related privacy concerns.

COMPARING 2020 EMPLOYMENT NUMBERS TO 2016-2019

So, let’s look at each industry to see what we can learn about the impact of the pandemic in 2020 and what that might mean should the virus again force some partial shutdowns.

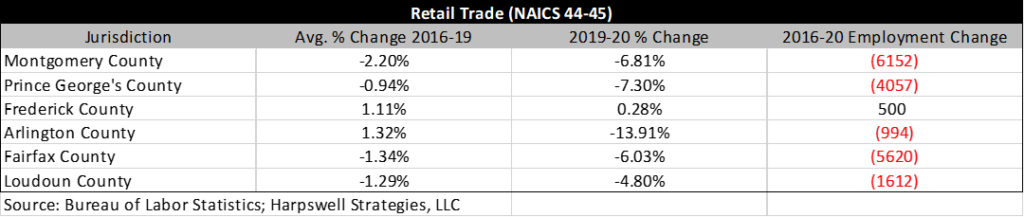

Retail employment in Montgomery County was down 6.8% in 2020, about double the national rate of decline (↓3.2%). Looking at the 2016-2019 numbers, retail employment declined more in Montgomery County than elsewhere in the region. As we have previously documented, the limited pipeline of new commercial development is one real limitation on the retail economy. In terms of the changes 2019-2020, it is clear that two things occurred – first, pre-pandemic trends continued/accelerated; second, Arlington’s retail was hit hard by the one-two punch of reduced in-office work and reduced pleasure and business travel.

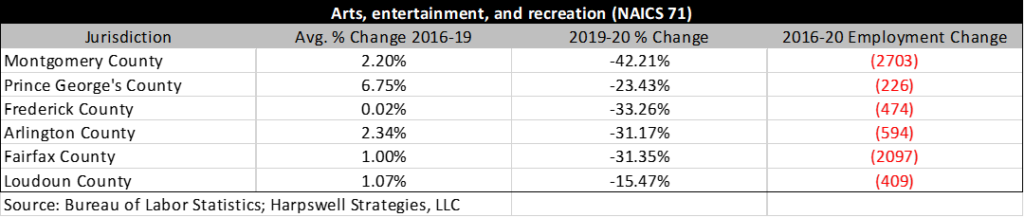

Employment in arts, entertainment, and recreation (performing arts, spectator sports, golf courses, etc.) was really hit hard by the pandemic, falling 31.9% nationally. Among suburban DC jurisdictions, Prince George’s was the leader from 2016-2019 in employment growth in this industry and not coincidentally fared somewhat better than other suburban jurisdictions during the pandemic in terms of employment numbers (no consolation). In terms of both 2019-2020 percentage change and 2016-2020 changes in overall employment levels, Montgomery County brought up the rear.

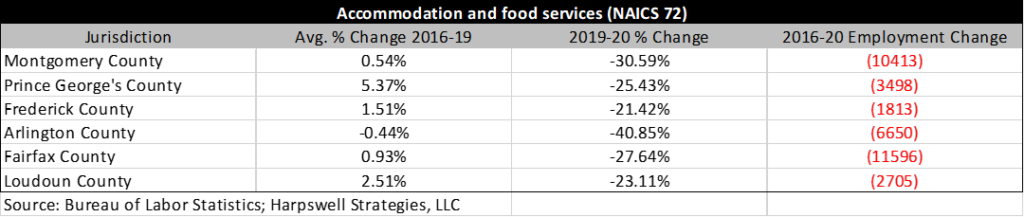

Nationally, employment in accommodation and food services declined by 23.5% in 2020. In the region, Montgomery County and Arlington County underperformed their peers from 2016-2019 and also experienced the largest pandemic-related declines in 2020. Arlington’s experience in 2020 was actually far worse than Montgomery County’s – almost certainly a reflection of the big hit that DC tourism took during the pandemic and the fact that Arlington’s hotel inventory is built to accommodate a lot more tourism-related demand than other area jurisdictions.

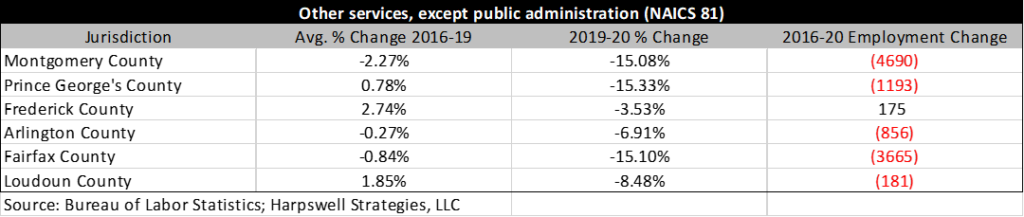

“Other services” is an industry that is so broad that I usually avoid talking about it in the aggregate, but here goes…This industry includes a little bit of everything (auto repair, car washes, parking lots, pet care, cemeteries and funeral homes, business associations, labor unions, human rights organizations, etc.). The reason that I included this catch-all category is that many of the industries and occupations are lower wage and require a lot of face-to-face contact, and nationally that led to a 13.6% decline in employment.

Montgomery County brought up the rear from 2016 to 2019 and experienced the largest overall decline in the number of jobs from 2016 to 2020. However, in terms of the pandemic effect Montgomery County had some company – Prince George’s County and Fairfax County fared somewhat worse. It is possible that what we are seeing is that the higher population/more dense population counties had more restrictive public health measures in place.

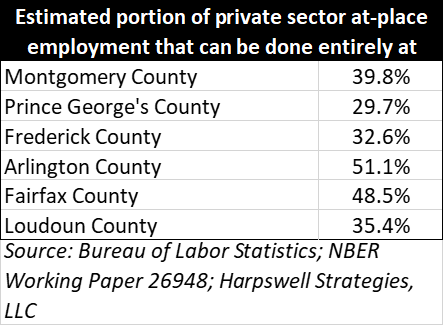

at-place private sector employment: Percentage that can work entirely from home, by county

Without getting into the weeds, I have been using a recent economic working paper as a baseline for understanding what portion of the workforce need not return to an office (i.e., have jobs that can be done entirely from home). The economists who wrote the paper, Dingel and Neiman, based their work on a review of the tasks associated with each occupation and the occupations associated with each industry. It has proven to be a good heuristic approach to understanding things like how many of the office workers might not end up returning to the office and therefore will not resume spending money near the office on items such as coffee, lunch, etc. In this case I decided to look only at private sector employment (excluding self-employment; also excluding federal, state, and local government employment). This decision was a function of the quality and relevance of the data available, and because County governments can’t regulate the federal or state workforces.

Based on the QCEW Employment levels by industry, and Dingel and Neiman’s estimates of the share of employment (by industry) that can be done entirely at home, 39.8% of Montgomery County private sector jobs can be done entirely from home. This means that Montgomery County is better positioned than Prince George’s County (29.7%) or Frederick County (32.6%) to absorb a body blow such as a partial shutdown, though Montgomery County is not as well positioned as Arlington County (51.1%) or Fairfax County (48.5%).

wrapping up

Here are a few numbers to keep in mind:

- Overall, 25.3% of Montgomery County’s private sector employment is in the 4 industries that are most vulnerable to the economic effects of the virus.

- During the year from December 2019 to December 2020, Montgomery County employment in those 4 industries declined by 20,396 (an 18.7% decline). These losses accounted for 60.7% of Montgomery County’s 2019-2020 lost employment. Montgomery County underperformed the national employment numbers in each of the 4 industries highlighted.

- This came on the heels of some lousy economic performance in 2016-2019, which supports the notion that at least some of the 2020 underperformance is a result of continuation or acceleration of pre-COVID trends. This is significant because while it is unlikely that the delta variant will lead to job losses of the same magnitude as what we experienced in 2020, it is likely that trends that existed from 2016 to 2019 and continued or accelerated in 2020 will continue to be relevant in 2021 and 2022.

- While Montgomery County’s private sector employment base is more “work-from-home capable” than some of its peers, it does lag behind Arlington and Fairfax, both of which have employment bases that even more “office oriented” than the Montgomery County employment base.

We’ll be back in a week or so with a look at some new economic data releases and what they tell us about the state of affairs in Montgomery County and the region. In the meantime, don’t hesitate to reach out if you have insights and observations about the current state of the economy. Be well, stay safe, and shop MoCo!