I’ve been thinking about the office market in Mo Co and in the region. In this month’s Mo Co Economy Watch, I attempt to bring you up to speed. Insert my friend Jeff Zyontz’s favorite quote from the Pink Panther 2: “Let me bring you up to speed. We know nothing. You are now up to speed.”

I could say that we are in the “price discovery” stage of the market cycle. That’s a term that is used when neither side of any transaction is particularly confident about pricing. On the other hand, “price discovery” is just a fancy way of saying “we know nothing.”

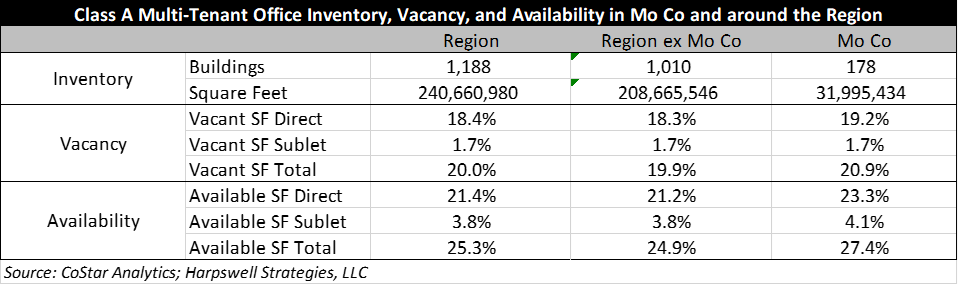

That said, let’s start by checking out Class A Multi-Tenant inventory, vacancy, and availability both in Mo Co and in the region…

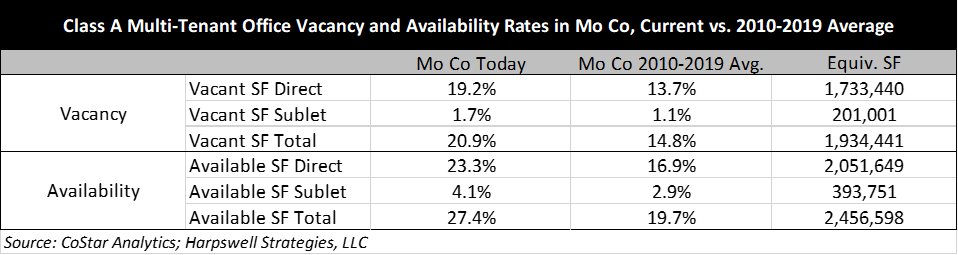

To provide some context, I checked the average market conditions over the pre-pandemic decade and quantified just how unusual this market moment really is…

Using today’s office inventory, if market conditions were at the 2010-2019 average, there would be about 1.9 million fewer vacant square feet (see right-hand column, third row), and about 2.5 million fewer available square feet. For reference, the average Class A Multi-Tenant building in Montgomery County is about 180,000 square feet, meaning that this equates to something like 10-11 vacant buildings and 13-14 buildings of available space above and beyond what we would normally expect in the marketplace.

Those are some big numbers and will place downward pressure on rents until that excess is absorbed. Given the headwinds, I imagine that this will take quite a while to sort out. It would take quite a while anyway given that the 2010-2019 average annual net absorption of direct + sublet Class A multi-tenant space is only 217,000 square feet/yr.

- Demand headwinds: Slowing economy; work-from home; a lengthy recent history of very few new businesses being formed in Mo Co; etc.

- Supply headwinds: Most office buildings aren’t well suited for non-office use; the time it would take to do so anywhere is long and in Mo Co it would probably take longer; and of course, most buildings aren’t entirely empty.

- Macro headwinds: The overall economy is uncertain and likely heading into recession; the interest rate is uncertain; and while the likelihood of the U.S. defaulting on its debts is low, the risk is still high because the potential impact to the national and global economy is incalculable.

The growing “negative leasehold” problem

Usually, sublet space commands less rent than space that is directly leased from the landlord. On average from 2010 to 2019, sublet space was 15% cheaper than direct space. This was true both in Montgomery County and in the region as a whole.

Currently, the average sublease rent in Class A multi-tenant office buildings in Mo Co is 75.3% of the average direct rent. That is an indication of the power of anyone in the market for office space today and is also a potential sign that prices will have to overcome a lot of downward pressure before they bounce back to pre-pandemic levels.

Interestingly, while Montgomery County and the region were similar before the pandemic when it came to the relationship between sublet rents and direct rents, the County has diverged from the broader region over the last three and a half years. Now, Mo Co sits about 3.5% below the regional average of 78.8%, which would obviously be even higher if we pulled Mo Co out of the regional totals.

My guess is that this reflects the higher vacancy and availability rates in Montgomery County. However, the real question is to what degree it will have a lasting impact on the rents that landlords are able to achieve when their current subtenants reach the end of their subleases and are ready to sign direct leases.

According to CoStar Analytics, average Class A Multi-tenant rents in Montgomery County are currently at $34.99 per square foot. Rents are projected to decline significantly over the next few years, bottoming out in late 2026 and early 2027 at $32.08. This will translate into a significant amount of market value lost – from around $278 per square foot today, down to $230 per square foot by the end of 2025 and then bouncing around in the mid-$220s in 2026 and 2027. I’m not going to do the math, but you can bet that some of this reflects the current vacancy and availability rates in Mo Co, and some of it reflects the growing discount for sublease space and the power that those discounts will exert on lease rates down the road.

The zombie apocalypse

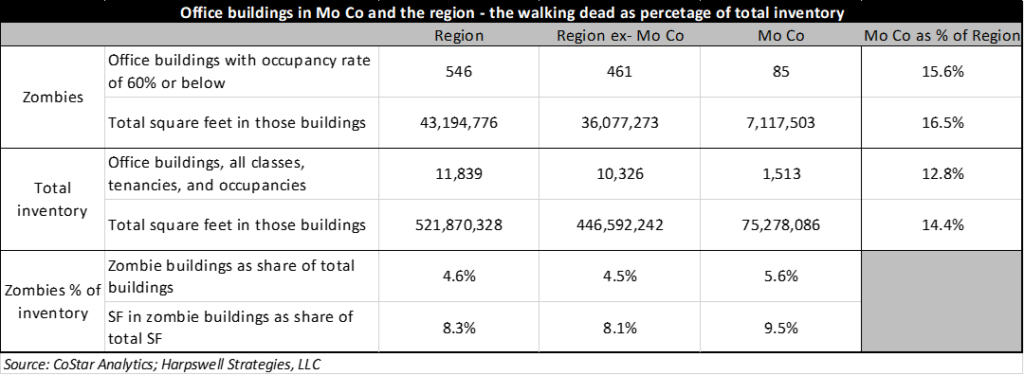

To judge from TV and movies, it’s a zombie’s world and we’re all just living in it. For as prevalent as the zombie theme has become, I remain surprised that Cemetery Man hasn’t been discovered or at least made available on a streaming service, because it’s a heckuva film…where was I? Oh yeah, there are a lot of undead office buildings in the greater D.C. region. This term is often used to describe buildings that are more than half empty, though one could argue that a better definition is office buildings with occupancy rates below the average loan-to-value ratio of 60% (this is the definition I chose, but it isn’t a choice I feel strongly about…).

- While Mo Co represents 12.8% of all office buildings in the region and 14.4% of all office square feet, it is home to 15.6% of the office buildings with occupancy rates below 60%, and 16.5% of the region’s square footage in such buildings.

- Similarly, across the rest of the region only 4.5% of buildings have occupancy rates of 60% or below, and these buildings include 8.1% of total office space. On the other hand, in Mo Co 5.6% of office buildings have occupancy rates of 60% or below, and these buildings represent 9.5% of Mo Co’s total office square footage.

This particular set of at-risk buildings is over-represented in Mo Co. Each week, more and more office building-owners hand over the keys to special servicers. We’ve seen some things like this in Mo Co already, and it looks like we can expect more and for a disproportionate share of such headlines in the region to be related to Mo Co office assets.

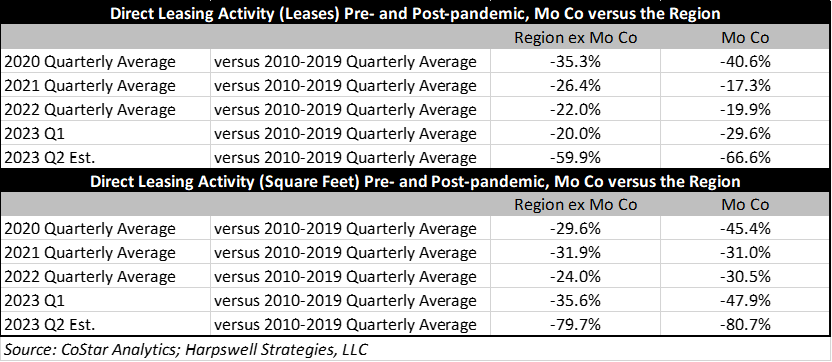

Leasing Activity

Just thinking about the demand side of the equation, both the region and Mo Co have experienced a steep decline in overall leasing activity, both in terms of the number of deals and the number of square feet involved. At this point, it really does look like relief in the office market has to involve a reduction in the supply of space.

Debt ceiling debacle

I’m not going to dwell on the debt ceiling debacle, and by the time I get this up on the web it could be over, but…since this topic comes up every few years, you never know when these links might come in handy.

- Moody’s Analytics has this recent update to their debt ceiling scenario analysis, which includes state-by-state unemployment impacts in both a shorter and longer duration breach. Hint: for Maryland, the impact would be measured in tens of thousands of jobs.

- Moody’s Investors Service has this piece on how the debt ceiling standoff could affect local government issuers. Here is a key takeaway from the analysis: “The ratings of debt issuers directly linked to the sovereign rating would likely move in lockstep. Issuers whose ratings incorporate uplift based upon assumptions of government support and those who receive substatntial federal transfers, or have outsized dependence on federal employment or federal procurement spending, are the most exposed…”

- Fitch put together a useful analysis of the potential impact on corporate borrowers (e.g., federal contractors).

- Fitch also highlighted the potential impacts on public finance and highlighted some risks to key portions of the debt market: “Bonds linked to the sovereign rating include municipal housing bonds currently rated ‘AAA’ and secured entirely, or predominately, by Fannie Mae and Freddie Mac mortgage-backed securities, pre-refunded municipal bonds where escrowed funds deposited with a trustee to advance refund the bonds are invested in U.S. government obligations, and bonds fully enhanced by FHLB letters of credit. Ratings on pre-refunded municipal bonds depend on the rating assigned to U.S. treasuries or other bonds guaranteed by federal agencies.”

You are now up to speed. Be well, stay sane, and shop local!