This week it is a grab bag of key trends/issues in the Montgomery County and regional office market. We touch on regional competition from our Maryland neighbors, leasing activity, work from home, bioscience, and a partridge in a pear tree.

MORE COMPETITION FROM PRINCE GEORGE’S AND FREDERICK COUNTIES

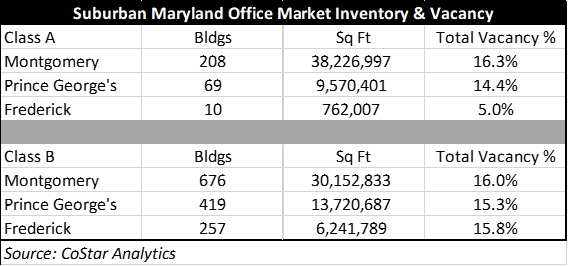

Let us start by acknowledging a truth – Montgomery County remains top dog in the suburban Maryland office market. However, Prince George’s County is gaining private sector jobs at a rate that matches or exceeds the rate of growth in Mo Co while Frederick is gaining some steam as a competitor. Let’s start by looking at how the 3 counties match up.

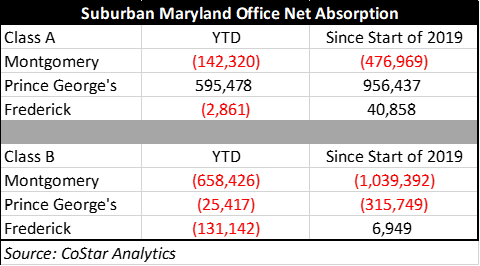

The inventory in Montgomery County is substantially larger, though I am less concerned with where things are than with where things are headed. Vacancy rates in Montgomery County are somewhat higher than in its Maryland neighbors, and demand for Montgomery County office space has been weak. The net absorption numbers will give us a sense of how well Montgomery County is able to handle the increased competition and what trajectory the County’s office market is on.

At a minimum, these net absorption statistics indicate that Montgomery County’s office market is struggling. In addition, it is fair to say that the Prince George’s County Class A office market is a legit competitor for new leases and that, overall, the Frederick County Class B office market appears healthier than the Montgomery County Class B office market.

LEASING ACTIVITY AS PROXY FOR RECOVERY

Over the past quarter-century, Class A leasing activity (direct and sublet) in Montgomery County averages about 2.6 million square feet per year. In the most recent 4-quarter period, total leasing activity has come in at 1.3 million square feet (50% below average). So, how much of that is a function of the pandemic? It looks like most of that difference – but not all – is a function of the pandemic. But Class A leasing activity in the County is down a little more than you would expect just based on the pandemic that has affected the entire world.

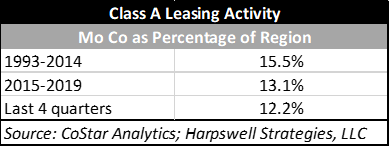

Let’s back up and start with some basics. Leasing activity, i.e., the number of square feet leased, is a one of many handy measures of economic activity. Looking at the region’s Class A office market from 1993 (earliest year for which data are available) through 2014, annual average leasing activity was approximately 17 million square feet annually. Remember that “divergence” that I have been talking about between the Montgomery County economy and the rest of the region? Well, it sure is evident when looking at leasing activity!

Class A leasing activity in the region excluding Montgomery County was up 16.4% on average during 2015-2019 when compared to 1993-2014. During that same time, Class A leasing activity in Montgomery County actually fell 4.8% when comparing 2015-2019 to the period from 1993-2014. Put differently, a chasm opened up between the performance of Montgomery County and the rest of the region in terms of the total volume of leases to top quality/investment grade tenants.

And predictably, looking at Montgomery County as a percentage of the entire region underscores the point. First, Montgomery County represents a declining share of overall leasing activity.

And secondly, over the past 4 quarters Montgomery County appears to have recovered less than the region as a whole. Maybe in the grand scheme of things it is just a blip, but the gap between Montgomery County’s recent leasing activity and that of the region is equivalent to about one office building leased (more than 100,000 square feet of additional Class A leases if Montgomery County had recovered as much as the rest of the region).

- Montgomery County’s last 4 quarters as percentage of 2015-2019 average leasing activity = 49.8% of 2015-2019 levels

- Rest of region excluding Mo Co = 53.9% of 2015-2019 levels

So, it is worth watching whether this divergence continues, accelerates, or abates. I think the “smart money” at this point is on accelerates; capital markets are already pricing this divergence into real estate transactions via wider cap rate spreads between Montgomery County properties and similar properties in neighboring jurisdictions (a topic I’ll be diving into later this summer!).

WORK FROM HOME AS FACTOR AFFECTING OFFICE ABSORPTION

I recently estimated the share of Montgomery County workers (at place, “covered” employment in Montgomery County establishments) that can perform their jobs entirely from home at 42.6%. That is, roughly 40% to 45% of people who work in Montgomery County for an employer have jobs for which they do not need to be in the office (based on employment by industry, and by job tasks by occupation within those industries).

Similarly, some firms are responding to their employees by reducing the number of in-office days – for example, Capital One recently announced that Mondays and Fridays would be work from home days. The downstream impacts of Capital One’s decision will end up affecting owners of nearby retail and restaurants who will miss out on around $3,300 annually of daytime spending per employee, but you can imagine other firms in the DMV making a different decision about how to spread those work from home days out in a way that will reduce real estate costs and real estate footprints rather than just designating work from home days.

The good news is that analysts are expecting vacancy rates in the County to remain near current levels for the next two years (around 16%-16.5%, peaking in the 4th quarter of 2021 and 1st quarter of 2022) before falling to a level (closer to 13%-13.5%) that would be elevated by historical standards but significantly better than the current rates. That said, we’ll need to keep an eye on these numbers to see how net absorption is affected by work from home and also to track the impacts on retail in submarkets where the health of local retail depends heavily on daytime population – those are among the submarkets where retail has struggled the most.

I think the long-term implications of working from home are fascinating, and I’m sure you do too – everyone hates a bad commute, loves a good lunch with co-workers, and has their own take on the 2020-2021 grand experiment in social isolation. For those who are interested, you might want to check out a good discussion over at census.gov about the data sources that can be used to estimate work from home for planning studies.

For what it is worth, here are a few questions and observations about work from home that are worth considering.

- Which office-industry firms will stay most attached to a physical office? Will it be companies with older workers, who may be less comfortable with work from home? Or will it be large, hierarchical firms with a substantial number of younger workers who crave social interaction or require close supervision?

- Is it possible to incentivize firms to require employees to go back to the office? That is the approach that the District is taking with its $30 million post-pandemic incentive fund – it will be interesting to see if there are any takers.

- Just as it is inevitable that August will follow July, it is also inevitable that leasing and location decisions will continue despite work-from-home. How should we estimate the economic impact of those leases? For example, workers who are required to be in the office less frequently might choose to live in outlying jurisdictions. The impact of that might be that incomes of those workers generate less local economic activity or income tax revenue. On the other hand, some residents – particularly those who are highly skilled or educated – might benefit from not needing to physically relocate for new employment opportunities. The income benefits of job-hopping are substantial, and one barrier to changing jobs has always been the cost and hassle of moving.

- When workers return to the office, will we see a change to their spending patterns? For example, will there be fewer lunches? And if so, will that be a result of changed behavioral patterns? Risk assessments? And how will the fact that there are fewer retail and restaurant options affect office worker spending levels?

I don’t know the answers to these questions and no one else does either. I do know that we will be in a much better position to plan and anticipate the future with a few more months of data and observation related to the geography of work and spending.

BIOSCIENCE OFFICE ABSORPTION

Historically speaking, growth in bioscience employment has “chugged along.” It has not driven the kind of explosive growth that many other high-technology, new economy industries have generated elsewhere, but it is a big part of Mo Co’s local economy. There are a lot of reasons that the rate of growth in the industry sometimes disappoints – it takes a long time to get a drug, treatment, or device to market; a lot of products never make it past the early trials; and many mature/successful companies end up leaving the DMV for greener pastures, to be closer to their funders, closer to manufacturing facilities, etc.

I recently recommended that the County move towards more industry-neutral incentives and tax credits – it doesn’t make sense to provide a lot of benefits for one industry and then watch other industries grow rapidly elsewhere in the region. And in the end, what Montgomery County needs is more good paying jobs in any industry, not just more jobs in one specific industry.

That having been said, bioscience continues to be an important industry for the County and will play a big role in the near-term office market fortunes of some specific submarkets – North Rockville/Shady Grove; North Bethesda/Potomac; Gaithersburg; and Germantown.

- North Rockville/Shady Grove submarket has generated substantial capital markets activity at different points over the past year. Increased NIH funding and venture capital funding for bioscience users is likely to generate opportunities and growth in this submarket and in neighboring Gaithersburg.

- The North Bethesda/Potomac submarket has some newer inventory, a pipeline of new development, and a County Executive effort to attract a large research user to the WMATA site at White Flint Metro. Among the developments to watch, Federal Realty Investment Trust recently proposed a 260,000 square foot office/lab building at Pike & Rose in response to demand for R&D-oriented office users; meanwhile, just down the Pike, Five Squares Development is marketing a 275,000 square foot biomed/office building at Strathmore Square. Both obviously have proximity to NIH and transit access working in their favor and offer current or future environments that will be heavily amenitized.

- Germantown’s office market has been stagnant for years, but there has been a perceptible increase in capital markets interest in the area. It will be interesting to see if that translates into a development pipeline that enables the County to capture some of the bioscience-related growth that might otherwise end up in Frederick.