In this second MoCo Economy Watch blogpost, we dive into some recent employment numbers to see how our most important sectors performed in 2020. Overall, what we find is that Montgomery County lost jobs in several important “white collar” or “office inclined” sectors during the pandemic, even though those sectors were among those least affected by pandemic restrictions. We believe that these declines represent the continuation – or even the acceleration – of longer run trends.

4th Q2019 – 3rd Q2020: STRATEGIC INDUSTRIES

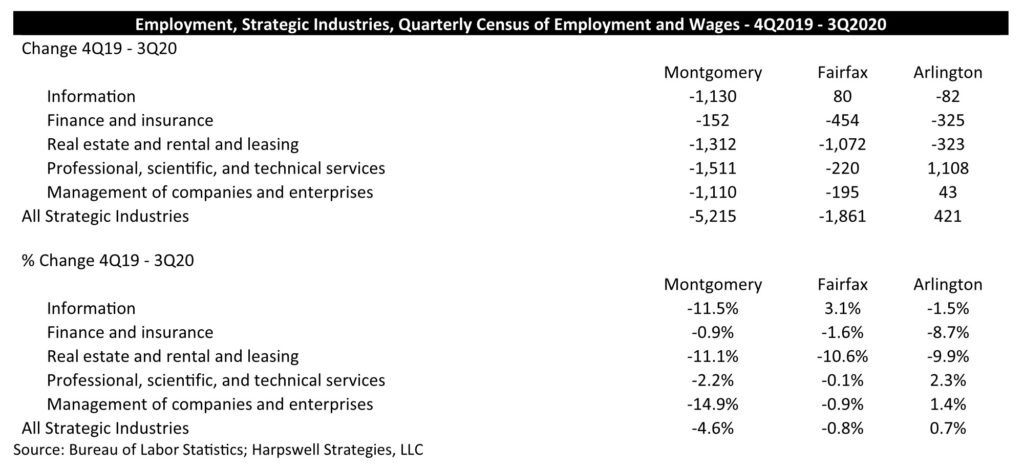

I started by looking at the data for a basket of 5 industries that I consider to be most important to Montgomery County. This

“strategic industries” basket includes the following: information; finance and insurance; real estate and rental and leasing;

professional, scientific, and technical services; and management of companies and enterprises. These are the key “white collar” or “office inclined” industries. The jobs in these industries generally pay high wages, and as such they are the key economic

development targets in knowledge-based economies.

What the Bureau of Labor Statistics data shows is that the County lost more than 5,200 jobs in strategic industries, while Fairfax and Arlington (combined) lost only 1,400 jobs in those same strategic industries. Montgomery County total employment in those industries declined by 4.6% over the 4-quarter period; in contrast, it was up by 0.7% in Arlington, and down by only 0.8% in Fairfax.

So, the most recent data we have indicates that Montgomery County has a problem that neither of the two Northern Virginia

economic powerhouses have – real deterioration in the health of some really important industries.

4th QUARTER 2019 – 3rd QUARTER 2020 EMPLOYMENT: OTHER LARGE SECTORS

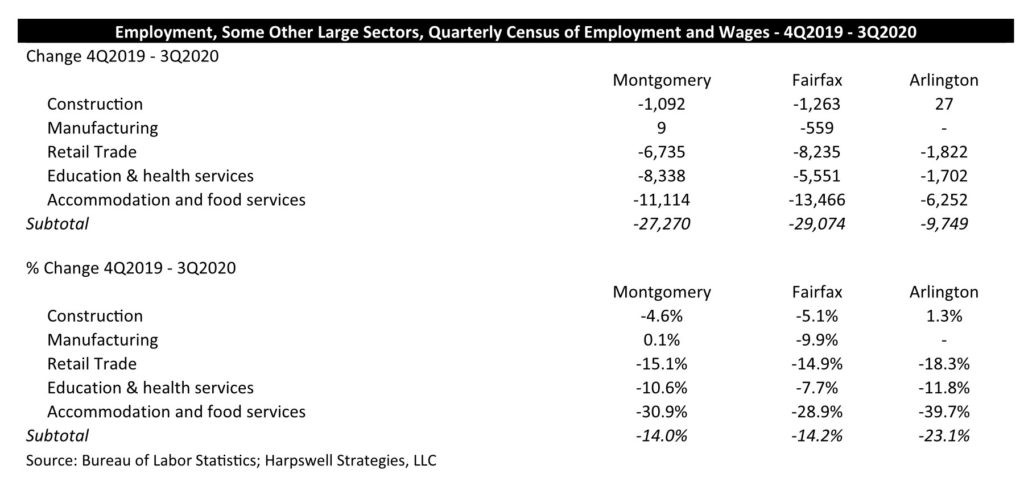

The strategic industries basket are the ones that are targeted by economic developers, but there are a lot of jobs – important jobs, good jobs – in other private sector industries as well. Let’s dig in and examine some of those as well.

What we see here are two separate things: Montgomery County outperforming the competition in manufacturing and Montgomery County performing similarly to Fairfax and Arlington in construction, retail trade, education & health services, and accommodation & food services. This tells us that there may be something different about manufacturing, and my first thought was bioscience-related manufacturing. However, that really isn’t the case – the really good news here is that employment was strong across multiple different manufacturing industries, and the total numbers were not juiced up by some really big increases in bioscience manufacturing. Unfortunately, manufacturing is only 5.2% of Montgomery County GDP – big enough to be an important stabilizer, but not really big enough to move the needle much in the absence of significant new investments.

One quick note of caution: I’m generally bearish on Montgomery County being able to hold on to its regional advantage in

bioscience-related manufacturing over the long run. We won’t see any big shifts there in the near term, but let’s set an alarm clock for 2025 and talk about it again then.

2010-2019 EMPLOYMENT: STRATEGIC INDUSTRIES

For the longer view, I went to the Bureau of Economic Analysis for County and industry-level employment data up through 2019. And what those data show is a pretty clear picture –total employment across the strategic industries increased in Montgomery County (↑9.1%), but at a much slower rate than in Fairfax (↑10.9%) and Arlington (↑17.6%).

The big picture here is that Montgomery County has really underperformed relative to Fairfax County and Arlington over the past decade. And I hate to be the bearer of bad news, but 3 events probably not fully reflected in these 2019 annual numbers are Discovery Communications’ defection to New York City; Amazon HQ2 jobs in Arlington and elsewhere across Northern Virginia; and the recent investments by Microsoft in Northern Virginia, including many jobs that had been located in Chevy Chase moving to Reston.

It is possible that the recent 4.6% decline in employment in the strategic industries is actually part of this longer-term trend. If so, one potential clue would be in the employment numbers for business services.

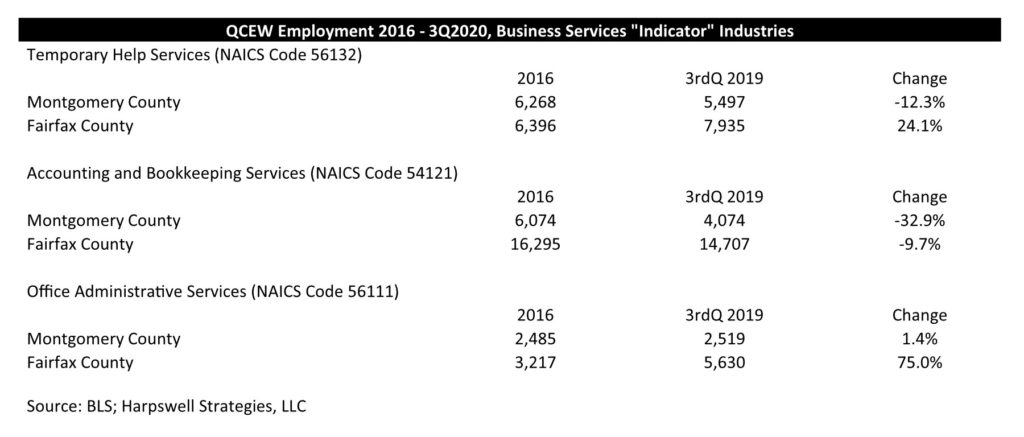

2016 – 3rd QUARTER 2020: “BELLWETHER” BUSINESS SERVICE INDUSTRIES

It is clear from the employment statistics for “bellwether” business service industries that Montgomery County and Fairfax County are diverging. Below are the statistics for temporary help services; accounting and bookkeeping services, and office administrative services.

Given the magnitude of those differences, I’m inclined to believe that the ugly 2019 and 2020 strategic industry numbers for

Montgomery County are not simply a function of the pandemic, but rather are reflective of a longer-run trend. And that trend is clearly shown by looking at these bellwether industries: the jobs that follow the jobs have already begun relocating to Virginia.

FINAL THOUGHTS

So, what to what to make of all this?

• With respect to manufacturing, hooray! Montgomery County has more than 2 times as many manufacturing jobs as Fairfax County (12,753 versus 5,114 in the 3rd Quarter of 2020), and our manufacturing sector held the line last year while theirs declined by nearly 10%. Furthermore, these numbers do not reflect a particularly strong showing in the manufacturing of pharmaceutical, medicinal, and biological products offsetting declines in other manufacturing industries. Rather, it appears to be a strong (or at least steady!) showing across the board and there remains some potential upside for the 4th quarter.

o Note of caution however: Many Montgomery County-based manufacturing jobs are in the biosciences. And while Fairfax County has little to no manufacturing in the life sciences yet, Fairfax County is gaining rapidly on Montgomery County’s historic dominance in research and development in the life sciences. In fact, from the 4th quarter of 2019 to the 3rd quarter of 2020 Montgomery County actually lost 141 jobs in research and development in the physical, engineering, and life sciences and Fairfax County gained 1,430 during that time. They are hot on our tail, and with that strong showing they closed the employment gap in that industry to less than 1,000 (10,034 in Montgomery County and 9,056 in Fairfax County).

• With respect to the strategic industries, yikes! Montgomery County lost 4.6% of the jobs in its most important sectors (high

salary, white collar jobs) during the pandemic. At the same time, employment was basically flat in these industries in

Northern Virginia. We shouldn’t expect a big bounce back (unless it is a statistical revision), as these industries were generally

among those least affected by the pandemic and related recession. My take is that this is a continuation (or acceleration) of

the decline we have seen for the past decade(s?).

• When it comes to “bellwether” business services industries, I think this is confirmation that things are not going well. I expect

this trend to continue as the geographic center of employment in the region continues to shift westward.

On June 7th , the Bureau of Labor Statistics is scheduled to release the 4th quarter 2020 employment numbers. I’m expecting that we won’t see huge shifts or anything that really changes the narrative. One sign that may be the case is that 4th quarter GDP for the State of Maryland was roughly flat across all the strategic industries (3rd quarter to 4th ).

That said, here is what I’ll be looking for in the numbers when they are released:

• Employment in the strategic industries across the region;

• Employment in Montgomery County’s manufacturing sector;

• Employment in Montgomery County’s bellwether/business services industries.