This month we take a quick peek at some retail market headline numbers, compare the region’s growth to that of some peer regions, and discuss some developing trends in the County’s struggling office market.

checking in at the quarter pole

We’ve been “getting down to brass tacks” on some of the economic policy issues facing MoCo…specifically:

- High taxes facing Maryland tenants/companies

- State and local taxes, net of incentives and subsidies, that are well in excess of those in neighboring Virginia

- The real estate market in MoCo is “pricing in” future reductions in earnings or increases in costs, thereby affecting capitalized values in transactions and also assessed values and tax revenues

- The significant effect of impositions on land value, such as inclusionary zoning, on public sector revenue

We’ve also discussed one mechanism that could be causing the accelerating decline – some firms and individuals “voting with their feet,” resulting in a loss of “critical mass” that contributes to the agglomeration economies that are so important to the productivity of metropolitan areas.

Furthermore, we’ve touched on the issue of whether the singular focus on producing affordable housing and requiring the market to set aside a significant portion of the units built as affordable, has maybe gone too far and may be contributing to a dearth of skilled labor for Montgomery County’s growth industries, given that most of the new low-income residents lack the skills that are in demand by firms in the County’s knowledge economy.

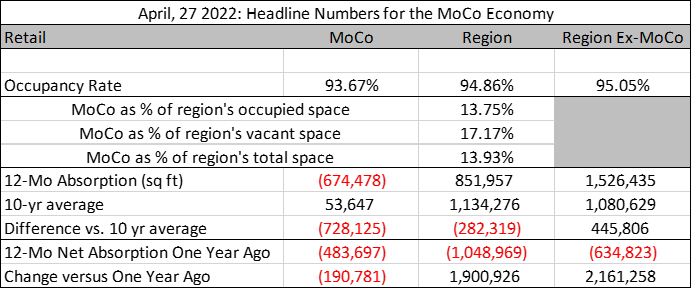

In the meantime, let’s check in on some headline numbers pertaining to the retail sector.

Here are some takeaways:

- Retail occupancy is lower in MoCo than it is in the rest of the region

- The region has seen positive net absorption of retail space over the past 12 months while MoCo has gone the other way

- Without MoCo, the region would be +1.5M square feet of occupied retail space; with MoCo it is +852K square feet

- The region excluding MoCo actually saw more positive absorption over the past 12 months than it usually does (+446K), while MoCo actually saw even less (-728K)

- Over the past year, the region’s retail real estate has gotten much healthier, while in MoCo it has gone from bad to worse

comparing the metro dc office market to some peer metro areas

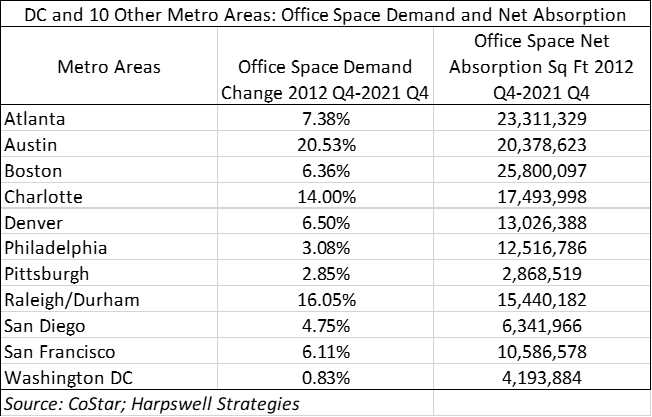

Sometimes I worry that readers will think that I am a one-note-johnny…but the MoCo office market is an important and compelling storyline. The County has so underperformed the region, that it is easy to lose sight of the fact that a more macro version of the story is that the County has really underperformed the region at the same time that the region has really underperformed other metro regions. MoCo is a county that is failing to compete in a region that has really had a rough go of it recently.

There wasn’t anything scientific behind these selections, but I grabbed numbers for several “sun belt” cities, a couple off mid-Atlantic peers, as well as 3 of our bioscience competitors (Boston, San Diego, and San Francisco). This should provide a good sense of why it is so worrisome that MoCo is bringing up the rear when compared to other jurisdictions in the region…

So, that’s just the “square feet” side of things…and again, just to emphasize the point, as bad as Metro DC’s net absorption looks relative to its peers, it is worth keeping in mind that Metro DC wouldn’t have done quite so poorly without MoCo – during this same time period, MoCo’s net absorption of office space was…ahem…negative (-472,895 square feet). Looking back, MoCo has experienced negative net absorption of office space in 12 of the last 13+ quarters (Q3 2019 was the only positive full quarter since the start of 2019).

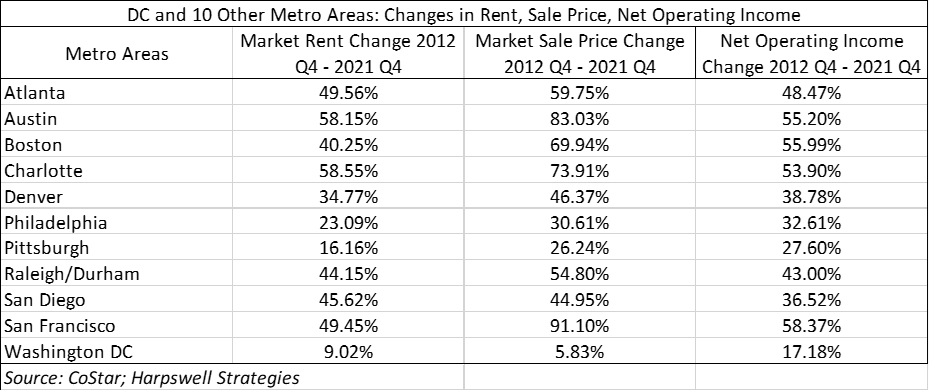

In case you are curious, from a financial metric standpoint the story is just as bleak.

The fact that office property net operating income is growing at a rate that is…less than 1/3rd that of Boston, San Francisco, and Charlotte…and about ½ of the rate at which NOI is growing for Philadelphia and San Diego office properties…should be worrisome. If this were British football, then the DC area would be in danger of relegation.

Office Market Update

MoCo is still reeling from the losses of Capital One and Discovery Communications and is now losing Clark Construction as well. In addition to Clark’s total footprint of more than 100,000 square feet, recent announcements indicate that two other significant tenants are leaving the county as well: International Baccalaureate is leaving 52,500 square feet at 7501 Wisconsin Avenue and taking a new lease of 111,500 square feet on Wisconsin Avenue NW in DC; and Brown Advisory is leaving 19,000 square feet in Chevy Chase/Friendship Heights for 32,300 square feet on Pennsylvania Avenue NW. One thing that all of these tenants have in common: they had been located in some of MoCo’s most walkable, transit accessible locations. That can’t be a good sign, because the County doesn’t have very many of those and the region’s demand may continue to shift to accessibility/walkability even during a period of reduced demand.

Looking just at offices built in the past decade, total new office space delivered in the region since 2012 is 41.4 million square feet, of which 26.5 million is within ½ mile from transit. Interestingly, Montgomery County doesn’t really play much in the transit-adjacent and transit-proximate office markets. For example, MoCo has captured only 9.4% of the new, multitenant, “4 & 5 star” space (so this would exclude Marriott HQ and the Montgomery County Judicial Annex in Rockville). This is not because there aren’t enough areas planned and zoned for employment uses; rather, there are plenty of locations and sufficient zoning envelope…but either they don’t appeal as locations…or the locations aren’t enough on their own to overcome the other challenges facing MoCo businesses and development.

Thinking ahead to the next few years, obviously the DC-area office market is not likely to be as robust as it has been. For example, Oxford Economics’ projections of job growth in key office using industries indicate that the DC-area economy is likely to add jobs at a slower pace over the next few years than it did over the past decade. Just based on some quick calculations, Oxford Economics’ projections indicate that office-inclined employment in the region is likely to grow at an annual rate that is about 40% below the annual rate over the past decade – this is largely driven by much slower growth in “professional and business services” (0.54% per year, compared to a recent average rate of 1.37% per year), which more than offsets a projected uptick in government employment (0.57% per year, compared to a recent average of 0.39%)…That is just one vendor’s forecast, but it is a decent reference point.

And of course, there are other significant factors (aside from employment in office-inclined industries) that will affect office demand in the years to come – work from home, reduced square feet per employee, federal retrenchment, etc. Accounting for slow job growth and increased work-from-home, it is easy to imagine future office demand that is 40% to 50% of recent levels.

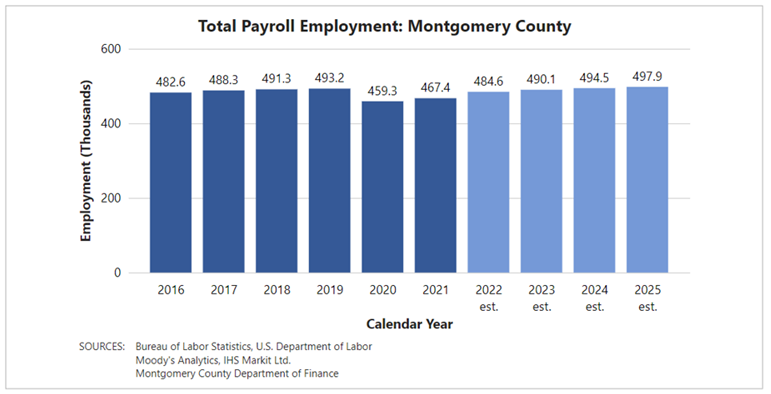

Furthermore, MoCo’s share of regional office growth has been shrinking, meaning that the County is likely to capture only a small (growing smaller!) share of the reduced regional demand for office space. Slowing regional job growth and work-from-home could further slow the County’s economy. As an example, while (as noted above) Oxford Economics projects regional employment growth in Professional and Business Services to grow at an annual rate of 0.54% annually, down from 1.37% annually over the past decade, that rate is still well above the recent trend in MoCo; to wit, MoCo added jobs in that industry at a rate of only 0.36% annually from 2011 to 2020. Similarly, regional employment in Information has grown by only 0.06% over the past decade, and Oxford projects that it will shrink by 0.85% per year over the next 5 years…but a decline of 0.85% annually would be a big improvement over MoCo’s actual performance in the industry over the past decade – MoCo employment in the industry has declined on average by 3.13% per year.

wrapping up

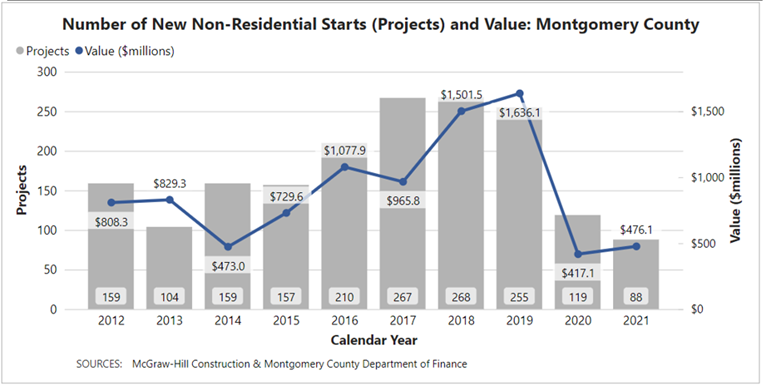

That all seems like a lot of bad news. Don’t worry, folks: as the County Executive recently told the Washington Post, “The growth happening in Montgomery County — it’s real, it’s happening.” His own budget tells a somewhat different story, though:

We’ll be back soon with more statistics describing the growth the County Executive sees! I know they’ve gotta be in here somewhere…