By Rick Liu, Senior Economic Advisor

During the pandemic, after countless frozen Zoom meetings from poor internet speeds, I’ve been thinking on and off about data centers and what, if any, opportunity they could provide for Montgomery County. But when Frederick County made waves two week ago by announcing a $100 million, enterprise level data center deal, I decided now was the time to dive into it.

Why should we explore opportunities from data centers? Consider the following.

- Data centers have been one of the most resilient market sectors to the pandemic, and are expected to grow 25% over the next 5 years, among the fastest of market sectors.

- Since 2016, data center expansion in the U.S. has increased 67%, while the overall commercial real estate market has decreased 2.8%.

- In 2020, ROI for data centers in the U.S. have grown +17.2% – highest of any sector – whereas traditional stalwarts like Office (-19.9%) and Retail (-28.3%) have declined significantly.

Unless this is the first Mo Co Economy Watch post you’ve read, I certainly don’t need to reiterate to you how stagnant Montgomery County’s office and retail markets are, and how much our real estate market could use a shot in the arm.

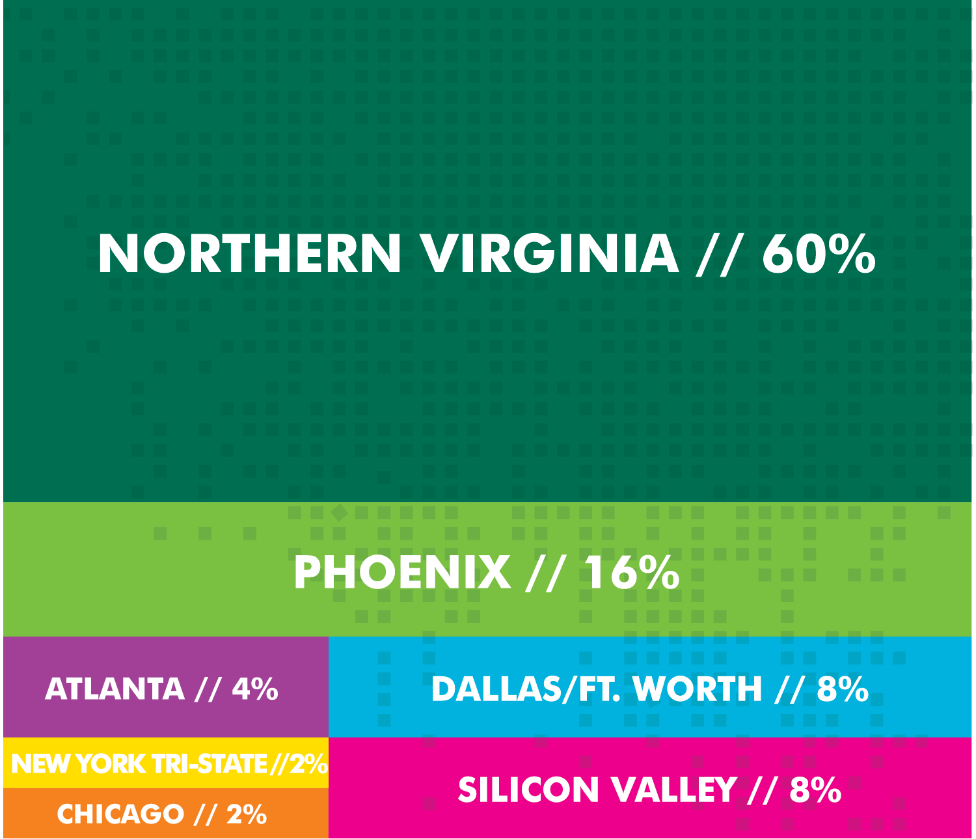

And I’m getting tired of talking about them too, but…..Northern Virginia (sigh). Or as one broker said, the “epicenter of the data center universe”. They represent over half the total data center inventory in the nation (as measured by power capacity in MW, directly proportional to SF), possesses almost as much as the second through fifth largest submarkets COMBINED, and is capturing over 60% of the data center investment in the nation. Northern Virginia has about 166 “colocation centers” (i.e. multi-tenant; this doesn’t include data centers that are single tenant) spread mainly between Loudoun, Fairfax, and Prince William counties; conversely, Montgomery County has three (and if you’re wondering, all built before the data center boom” happened in the last decade).

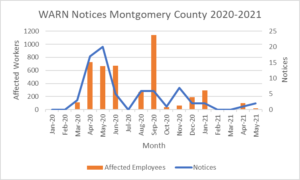

Data Centers Under Construction in U.S. (2019 First Half)

So data centers haven’t been eyeing us across the crowded room, but in fairness, we haven’t really been looking at them either. But should we? Given the renewed importance of reliable and fast broadband speeds, should data centers play a role in our future? Could they also help shore up our property tax base and bring high paying jobs to the area?

What are data centers? Where do they want be?

As a layperson who knows little to nothing about data centers, I sought to explore this topic by interviewing brokers, data center owners, and networking engineers, attending conferences/webinars, and read up on it as much as I could. As I learned, data centers are essentially these nondescript, warehouse-type facilities that house servers and networking equipment to support IT operations for businesses; kind of like the chilly server room found in your office. Sounds simple, right? But when you consider the fact that the total amount of data has increased by more than 100,000 times between 2010-2020, data centers have now become exceptionally large, evolved, and sophisticated, and can attract among the largest of private capital placements. One expert on a panel said we’re probably just tipping the iceberg, since he “can’t see anyone in the foreseeable future sending less email, taking less photos, streaming less movies, or working from home less.” I can’t either.

Couple of quick facts about data centers. Modern ones range from 50,000 to 100,000 SF – or about 60MW on the higher end as measured in power – although that number is trending upward, particularly in Northern Virginia. Tech titans like Amazon, Google and Facebook are building their own “hyperscale” facilities that possess 100 MW+ to handle a tremendous volume of data, processing and storage, which I learned is one of the key trends in the industry’s future.

So where do data centers want to be? Combining what I learned from my research, interviews, and conferences, some commonalities came into focus.

- Reliable Power/Low energy costs: Unlike office or retail, energy costs are tremendous; over a data center’s lifetime, it costs roughly 10X to operate it than to build it. To date, data centers consume about 1% of electricity worldwide, well in excess of their share of global real estate. That consumption is not just for powering the servers; in fact, about 35%-45% of total energy is used to cool the data centers so they don’t overheat and fail. Naturally then, data centers want to be where power is both reliable and inexpensive. Dominion Energy offers both; energy costs in Northern Virginia are 5.2¢/kwh, about 20% lower than the national average (for comparison, Austin, TX [7.4¢/kwh] and Northern California [13.4¢/kwh] represent mid and high ends, respectively).

- Proximate to Fiber/Connectivity: One of the first Internet Exchange points in the world (MAE-East, a nice play off Mae West) was established in Vienna, VA in 1992, where large internet companies like AOL subsequently built out fiber infrastructure. This exchange, along with all the associated fiber infrastructure (notably the 7.2 mile fiber ring completed in Ashburn in 2016) turbocharged data center growth in Northern Virginia. The combination of the 1.) exchange in Northern Virginia and undersea cables entering Virginia Beach, 2.) the fiber ring, and 3.) the constant fiber redundancies generated by new data centers created nearly insurmountable competitive advantages for data center development there. But perhaps more important is WHO is building the data centers; in 2020, over half of the data center absorption in Northern Virginia were social media companies. And no, once they planted a flag they’re onto doing far more than just building data centers.

- Inexpensive Land/Space to Build: Well, at least it started out that way. Back in the 90’s and early 2000’s Ashburn was largely rural, so land was inexpensive, flat, and mostly greenfield. Today, bidding wars for data center land in Loudoun County now run up to $1M-$2M per acre; a quick check online indicates that to be similar to a commercially zoned property in downtown Germantown. Adaptive reuse is still fairly rare – sorry struggling office owners – although interviews with brokers say it’s not impossible if an existing building is only 1-2 stories lower is better, as floor loads need to support heavy equipment) and have excess surface parking that can be taken out (substations need to be added to each data center).

- Economic Incentives: Unlike other types of commercial real estate, so much of data center costs are in whats going on inside the building rather than developing it. Energy costs are a big driver as I mentioned, but private companies also spend about $25M per MW for server equipment and machinery. So in the 60 MW data center example, that’s $1.5B that would otherwise be taxed at the 6% personal property tax rate! Naturally, most of the incentives are targeted to sales and use tax exemptions, as long as certain targets are met (usually related to jobs, wages, and whether they’re located in disadvantaged areas). Incentives DO have an impact: to date, no large-scale data center has located in a state that imposes a full-sales tax burden on data center equipment. The LEVEL of incentives are also important; Virginia enacted its first sales tax exemption in 2008, but relaxed its criteria in 2013 when Apple chose to build a $1B facility in North Carolina. According to the Northern Virginia Technology Council, that was the crucial missing element that led to the data center explosion in Northern Virginia.

- Speed to Market: Again, unlike other types of commercial real estate, data center tenants have a shorter timeframe to get into a space than office or retail tenants. Brokers indicated that tenants are often looking for space within a 6-8 month timeframe, and that’s not just existing space, that’s ground-up development. This is important because these data centers are serving tech companies that need to grow tremendously fast in a short amount of time – we’re talking months – and will turn to other locales if their timeline is not met. The Director of Economic Development in Prince William County specifically mentioned that their fast-tracked construction permitting for data centers was critical to making them competitive with Loudoun and Fairfax County.

- Other Factors: Other key factors to data center location include being in places less prone to natural disasters (again, power reliability), access to reliable water sources for cooling, and an educated tech workforce to not only help them operate and maintain the data centers, but also to serve as potential future tenants as start-up companies are attracted to edge computing.

So, how competitive would Montgomery County be?

Well, you probably have an idea based on what you just read, but let’s take a quick detour and talk first about what we HAVE done.

- First incentive (2014): Back in 2014, when the Citibank vacated a data center in White Oak owned by BYTEGRID due in large part to the County’s energy tax (more on this later), the Montgomery County Department of Economic Development took a “half-step” and created a fund which would rebate 1/3 of personal property equipment tax to a tenant at BYTEGRID. Unlike most state incentives however, this 1.) only exempted 1/3 of personal property tax rather than the whole enchilada, and 2.) only applied to the one data center in White Oak rather than unbuilt ones.

- Latest incentive (2020): In May 2020, a much more comprehensive data center incentive legislation (Senate Bill 397) passed the General Assembly in Maryland. I won’t go through all the details, but it authorized a full personal property tax exemption for 10 years for projects that meet certain job creation, wage and investment thresholds. Give credit where its due – I actually think the framework is pretty competitive, and even goes a bit further than that in Loudoun County. But this was only after 35 other states already had incentives and racked up a sizeable head start.

So, with the Maryland incentive now in place, would that actually change the landscape for data centers in Montgomery County? Perhaps, but let’s review the hurdles.

- Energy costs: Dominion charges electric rates that are 20% less than average; commercial energy rates in Montgomery County are roughly over 20% higher than Northern Virginia, not to mention the (drumroll please)…. ENERGY TAX! (frankly, I’m impressed I didn’t get to this until this far down). The County’s energy tax tacks on an additional 2¢/kwh for commercial customers. Essentially, this means that the energy costs of running a data center annually would be 60% more here than in VA, and if we’re adding a surcharge to what’s already the highest expense for a business, we’d either have to exempt them from the energy tax or significantly raise the level of incentive.

- Proximity to Fiber: Despite a short fiber route built in 2017 under the Potomac River to one of the County’s three data centers located in Rockville, Montgomery County still has very little of the fiber diversity or fiber redundancy that’s needed for data center reliability and speed. For the most part, most of the County’s internet traffic is still first going into McLean or DC, then back out to Ashburn, which causes more “latency” (fancy word for lag).

- Inexpensive Land: As frequently noted by the Montgomery County Planning Department, between the Agricultural Reserve, environmental and zoning constraints, and existing development, only about 15 percent of the land left in the County is truly available for development. Most of the areas with commercial-zoned land that the County is trying to stimulate are infill, redevelopment opportunities envisioned for higher density, which frankly run counter to data center construction.

- Speed to Market: The entitlement and permitting process in Montgomery County can be a heated topic, and I don’t plan to address that here. But whether you think it’s too slow, too fast, or just right, I think we can agree it’d be a tall order to for Montgomery County to meet the entitlements of a 6-8 month ground-up delivery timeframe (we’re talking approvals within weeks), particularly if we have little to no experience approving these.

Worthwhile for MoCo to Pursue Data Centers?

I don’t want us to forget that whether we CAN do something isn’t the same question as whether we SHOULD. As someone who regularly thinks about the County’s economy, the natural place I go to is its impact on our tax base and economic development prospects.

The primary knock against data centers – which is a legitimate knock – is that they don’t generate many direct jobs (a huge data center on average generates about six direct jobs, and current trends point in the wrong direction). Each individual data center doesn’t generate much property tax; property values are closer to higher-end industrial/warehouses than office buildings (although often what is overlooked is data centers put very little strain on public finances, with low impacts to schools, traffic, and an absence of things typically found from industrial buildings like odor, truck traffic and crime). But having researched this topic, I actually think even the direct economic impact of data centers is understated (not to mention the potentially huge indirect impacts, which I’ll mention at the end). To date, the data center industry unquestionably been an economic boon for Northern Virginia, estimated to have provided over 14,000 jobs, with an average annual pay of $126,000, and over $600 million in state and local property tax in 2018. To put a finer point on it, if not for the economic impact of the data industry, Loudoun County would have a property tax that’s 21% higher than it currently is.

But I’m mixed on whether it makes sense for Montgomery County. For starters, the County has become more and more dependent on the energy tax (regardless if you think its good policy) and I’d be hard pressed to see the County to introduce legislation to exempt data centers, especially if the industry isn’t banging down our door anyway. Our county is more mature development-wise than Loudoun was in the early 2000’s, and redevelopment is far more expensive that greenfield development. Moreover, our commercial office and retail properties have not dropped anywhere near the value it takes to make data centers competitive (a good thing!). Lastly, it bears mentioning that unlike traditional real estate, data centers of today and their equipment are likely to become obsolete in less than a decade. While I think its likely most will adapt – especially since they’re properties owned by trillion dollar companies – its possible many could become dormant eyesores 20 years from now.

Still, even if don’t have a clear answer on data centers themselves, all of this has me thinking about how Montgomery County can skate to where the puck will be rather than where we’ve been if we want to futureproof ourselves. I’ll leave you with these thoughts (and I’ll throw in a future opportunity to capitalize on).

- Fast broadband becomes a necessity not just for business, but residents: For decades we’ve always defined our “quality of life” by things like our schools, parks and recreation, and outdoor amenities; even as we lost out on jobs, we’ve retained resident satisfaction. But given what we’ve experienced this past year and the growing movement to remote work and “tele-everything”, it’s not a stretch to expect high-speed, broadband access to become a key factor in where residents want to live (as evidenced by the frozen Zoom calls I mentioned in the beginning). Plainly put, this requires investment in the physical, underground fiber and fiber redundancy that Northern Virginia has in abundance (and no, 5G small cell antennas alone are not a substitute, they depend on fiber even more). Could we find ourselves behind the 8-ball again one day?

- Data Centers in northern Montgomery County: Even if we can agree that a data center isn’t appropriate for a place like say, White Flint, what about sparser places up north like Clarksburg, Hyattstown, or Damascus where the where the opportunity cost for development is low (and the impacts to the surrounding road network and schools is minimal)? In fact, Northern Montgomery County may even be more competitive than we think given the recent data center deal in Frederick County I alluded to in the beginning, and their County Executive is already optimistic the jurisdiction can position itself as a lower-cost alternative to Loudoun County on its future data center development. We could be competitive on land prices in this arena; the question is whether we want to be.

- Attracting the Employers of the Future: This is really the holy grail, in my opinion, which is the potential indirect impact of data centers. When Facebook, Google and Amazon (not to mention multiple others in the Dulles Corridor) build and own property in Virginia, they start to build relationships with local and state officials, begin to settle into the environment, and ultimately make bigger and higher-value investments into the area (no different than getting a foot in the door and expecting it to widen). The results speak for themselves.

Conversely, Montgomery County has chosen to emphasize investing in the “long-game” of STEM education and attracting institutional partnerships, but has not gotten any traction with the companies of tomorrow despite an educated workforce (we’re not even winning on STEM education: Amazon Web Services started a paid apprenticeship program at Northern Virginia Community College, and in 2018 graduated its first students into full-time Associate Cloud Consultant jobs). Reading this, I can’t help but think that with our educated workforce, we just need a spark or catalyst to get these firms to look our way. So even you think data centers aren’t the answer, we’re left with the problem on how to meaningfully engage these firms and get them to put “skin in the game” before they’re more confident about investing higher-value tech jobs in the area.

Oh, and it’s not just the big tech titans either. The tiny tech start-ups poised for rapid future growth will need also lightning speed, reliable, low latency internet access to process massive amounts of data quickly, rather than a large, centralized server dozens of miles away. This means communities that have facilities locally that can process that data will have a leg up in winning over the type of businesses that will be driving our future economy.

- And One Opportunity for the Future. While the 5G small cell OUTDOOR antenna debate in Montgomery County continues, realize that outdoor antennas don’t have the range to penetrate indoors and 80% of internet usage remains inside buildings. Perhaps a 5G building retrofit fund to revive our moribund office market? Email me your thoughts at rick@harpswellstrategies.com

Rick Liu is Senior Economic Advisor to Harpswell Strategies, LLC and is an independent consultant at RYL Economic Strategies of North Bethesda.