This month we kick off our 2022 Flotsam and Jetsam series – assorted economic observations that are relevant to MoCo’s economy and “body politic.” There hasn’t been a lot of local or regional economic data worth spending time on this month, so we’ll focus on some of the trends that will shape the next few months. Risks abound, so there is plenty to think about.

Headline numbers

While the DC Metro Area economy experienced employment growth into November, it is worth reminding everyone that there are at least 3 reasons why we’re not giving this much weight in terms of our understanding of MoCo today: (1) the longer-term trend is a growing divergence between the performance of the MoCo economy and the area economy; (2) real-time data, such as commercial leases, indicate that MoCo had a much rougher go of it than other area jurisdictions; and (3) those numbers are looking back at a pre-Omicron period of time.

CoStar has a handy office utilization index, and it pegs mid-November and mid-December office utilization for the region at around 35% of pre-pandemic levels. That number has since dropped down to 23.3% in mid-January. This will be an interesting index to keep an eye on in 2022.

Here are the commercial real estate headline numbers for the MoCo economy.

Office occupancy

- MoCo’s office occupancy rate declined from 87.9% in 2019 to 84.3% in 2021 (↓3.6%).

- Office occupancy in the region (ex-MoCo) declined by a much smaller amount (↓2.0%).

Office leasing activity

- MoCo office leasing activity for 2020 and 2021 dropped sharply relative to the 2010-2019 average (↓40%).

- Leasing activity in the region (ex-MoCo) declined by a much smaller amount (↓33%).

- From 2010-2019 MoCo represented 15.6% of office leasing activity in the region, but for 2020-2021 that number is down to 14.2%.

Retail occupancy

- MoCo’s retail occupancy rate declined from 96.2% in 2019 to 94.9% in 2021 (↓1.3%).

- In the region, total occupied retail space has declined by 1.22 M square feet; MoCo represents a remarkable 50% of that decline (0.61 M square feet).

Retail leasing

- MoCo retail leasing activity for 2021 is sharply below the 2010-2019 annual average (↓19.7%).

- By way of comparison, the region (ex-MoCo) was down quite a bit less compared to the 2010-2019 average (↓13.3%).

In some respects, the office and retail struggles are two sides of the same coin: fewer people working in MoCo, and fewer high paying jobs means less money greasing the wheels of local commerce.

Labor substitution and automation trends

One of the “first principles” we laid out in our look ahead at 2022 and beyond is that “black swan events” often accelerate pre-existing trends. One area to keep an eye on is the balance of labor and capital inputs in the broader economy.

Some data definitely supports this concern– for example, labor services as an economic input dropped by 5.1% from 2019 to 2020 even though the productivity of labor (per hour worked) increased by 2.5% year-over-year. At the same time, capital intensity (a measure of the degree to which the economy depends on capital inputs) increased by 9.5% from 2019 to 2020. This 2020 increase in capital intensity outpaced both 2009 (↑8.7%) and 2001 (↑7.1%). On the other hand, it is still difficult to tell to what degree the pandemic changed this trajectory. For example, software purchases by private businesses were up in 2019 (↑8.9% versus 2018, well above the 6.8% average annual increase from 2007 to 2019).

In the past, the impacts of labor substitution and automation have been most evident in expensive labor markets. Over time, it will be interesting to look at trends across metropolitan economies and to compare trends within multi-jurisdictional regions. If the effect is what I suspect – i.e., a shift away from labor to capital that is even more pronounced in jurisdictions with high labor costs, I hope that the response will be to finally shift away from poverty reduction and social safety net programs that are tied to employment status and more towards just basic income support programs.

A recent European study estimates that automation will lead to the loss of 12 million jobs in Europe…This piece in the LA Times does a good job of laying out the potential impact on service sector employment…For those who haven’t used their monthly maximum of free NYT articles, this one from fall of 2021 is worth a read…This piece in Time Magazine is a good, quick read. Who knew that you could hire a robot security guard for $3.50 to $7.50 an hour?…And for those who are a little more economically inclined, this piece by a renowned MIT economist is worth the time. Acemoglu makes the case that a lot of this automation is excessive, i.e., that firms are spending more than they should on automation and that the result is a decline in productivity. Just recently I was watching TV and realized that almost every ad that aired was an ad for a product that seemed “over-engineered.” For example, do I really need windshield wipers that can be frozen into a block of ice and then subjected to the heat of direct flames? If I end up needing to drive my gas-powered car through a winter forest fire in 2022, then I suppose we’ll probably be looking back at 2020 and 2021 as “the good old days.”

Focus on the consumer heading into the mid-terms

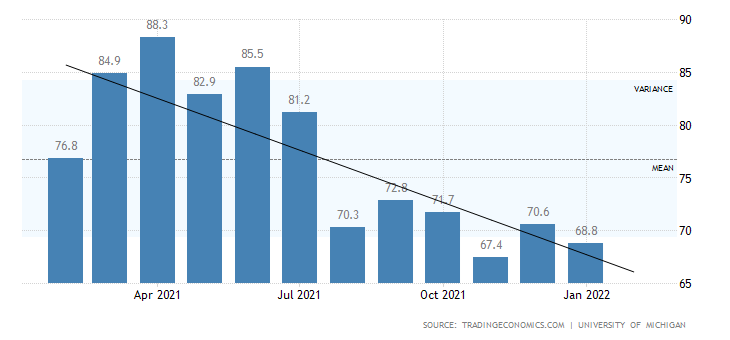

Looking ahead at 2022, almost every economic forecast or survey I have seen indicates that we are likely to see real disposable personal income go negative this year, and most of those forecasts have become considerably more bearish recently. Eyeballing the papers arrayed on my desk, I’d say that most forecasts are pretty close to ↓3.0%, and that over the last few months the 2022 forecasts have gotten much more bearish. Fall 2021 data indicates that real personal disposable income is already declining, and analysts expect that to continue until fall of 2022. Consumer sentiment is already near its lowest level in a decade and has been declining steeply since the vaccine euphoria of April 2021. I am old enough to remember that euphoria; fortunately, I am also old enough that I have forgotten many of the hopes and dreams that I had for the future all those months ago…

I highlight this because declining real disposable income seems like the sort of thing that can really affect political stability and election results. Unsurprisingly, the wisdom of the crowd indicates a likely GOP takeover of both the House and the Senate. The House result seems like a foregone conclusion, but the crowd is more certain of the Senate than is warranted.

Thinking about the downside of asset values

It was a horrible week for the stock market, and while many economic fundamentals remain strong, signs of froth abound. One thing to think about as we get ready for a de-leveraging is how far asset values could fall.

Let’s start by looking at market values of real estate and corporate equities held by households and non-profits.

- From Q3 2020 to Q3 2021, the value of real estate assets held by households and non-profits increased by 14.7%.

- The value of corporate equity assets held by household and non-profits increased by 37% over this period.

- The net worth of households over that period increased by 17.7%, while the net worth of non-financial businesses increased by 14.4%.

A significant drop in the stock market (remember – the S&P fell by 56.8% from its peak in October 2007 to its trough in March 2009) could lead to substantially diminished household wealth. And diminished household wealth is more of a problem for MoCo than it is in a lot of places, due to the County’s dependence on taxing high-value residential real estate and income derived from capital.

Furthermore, the household savings rate – while still above 2019 levels – is coming down from pandemic era highs. For example, in Q3 2020 the savings rate (NIPA method, NIPA data) was 16.03%; subsequently, that figure fell all the way to 9.56% by Q3 2021. My baseline assumption is that there will be some more “helicopter money” for the household sector in 2022. But if the GOP takes over the House later this year, it certainly would be possible that they would block efforts to provide more in 2023 and 2024. That would be a problem if you assume, as I do, that helicopter money will be needed every 9-18 months for the foreseeable future.

Rapidly declining asset values could lead to some real political instability here and abroad. A scenario in which asset values drop, household savings are low, consumer prices are elevated, low-wage jobs are lost to robots, and there’s no fiscal help in sight…well, that would be even worse.

Wrapping up

That’s it for this month’s Flotsam and Jetsam. In February we plan to cover a couple of interesting topics – a review of bio-med real estate market activities in the DMV and Boston, and a review of how the Great Recession unfolded in terms of local economic activity and County revenue. Until next time, do whatever it takes to stay sane and safe…And shop MoCo!