This MoCo Economy Watch is a bit of a departure from what we usually do. Rather than focusing on economic data or policies, we’re going to navigate a gordian knot – the challenging economics of large-scale suburban master-planned developments.

To do that, we’ll explore several related topics. This week, we will discuss amenities and public benefits, infrastructure, and community facilities. Next week we’ll explore the time value of money and how it is different for public and private sector actors. Together these two problems explain a lot of the challenges facing complex redevelopment projects and why some such projects need incentives, tax credits, abatements, tax increment financing, and other public sector financing tools.

SOME CONTEXT

Whether a neighborhood is in good shape or bad shape, there is always something that a neighborhood doesn’t have or can’t access. Consequently, in every plan there is “a planning problem.” Planners identify the problem, assess potential solutions to that problem for and with the community, and build consensus around a solution.

When the “planning problem” is how to make an unattractive area more attractive, or an underdeveloped area more developed, it’s a decent bet that the rents are low and that the planning problems are widespread and expensive to fix. In such cases, there is a lot of work to be done and money to be spent by both the public and private sectors – there really is no way for the private sector to solve the planning problem on its own simply by building a shiny new building or adding on-site amenities.

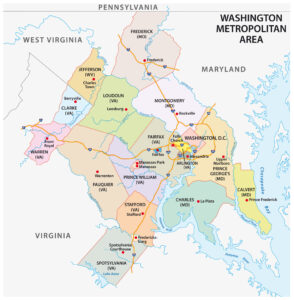

One reason for this is that any new building represents only a small share of the market’s overall supply. If a new apartment building goes up in North Bethesda, the rents that the market is willing to bear are determined by rents in other nearby submarkets and in other similar buildings throughout metro area. A new apartment building in North Bethesda represents a small share of the County’s housing units or apartment units, and a small share of the Class A apartment buildings across the metro area. Consequently, each project or property owner has relatively little pricing power.

Since the building owner can’t just set the rents to achieve whatever level of rent will generate the return that is necessary to pay lenders and equity investors, then the only real control is on costs. But most of the building costs aren’t flexible or negotiable – if you need an elevator, it has to go all the way to the top…Steel, lumber, and concrete are commodities and products that are demanded all around the world by many different industries, so cost inflation is a factor outside of the project’s control…Each new development project represents a small share of the overall labor market, so there isn’t much power to set prices there…I think you can see where I’m going, but it is an important point – there often isn’t anything that is entirely within the control of the developer that will toggle a project from “no go” to “go”.

The same is true of a lot of building and site-level amenities. A property owner can’t attract tenants – especially to an underdeveloped or struggling area – unless building and site amenities are part of the value offered to potential tenants. And if there is very little connectivity to nearby areas, then the importance (and cost) of those amenities will only go up because there are no other amenities nearby or accessible.

A self-contained mixed-use project can offer a lot of amenities, but it does so at a cost. To be more specific, it is a cost that the developer of a single vertical building in an infill environment probably doesn’t face – the cost of providing everything on site that otherwise would be just around the corner. Your office tenants need a place to go for lunch? If there are no restaurants nearby, then you need to develop some restaurant space and the parking that goes with it (and subsidize the restaurant rent to boot!). Your apartment tenants need some space for outdoor gathering or recreation? If there is no plaza, playground, or gathering space nearby/accessible then you need to provide it on site. You get the idea…

But providing those building and site amenities doesn’t mean that a project can achieve rents that justify redevelopment. If the planning challenge in a particular area (say, White Flint/Pike District or Twinbrook) is that crossing the street to get to a Metro station is too dangerous, then anything short of addressing that specific problem is unlikely to move the needle from “no go” to “go.”

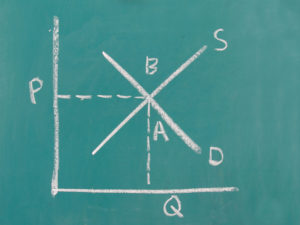

Localized public sector investments in public infrastructure and community facilities are essential to changing the nature of these redevelopment areas, and it is difficult to achieve the rents that justify private sector redevelopment projects in the absence of catalytic investments that change the nature of the local area to be redeveloped. However, when those investments are made early on there is an opportunity to monetize those investments through the property values – tenants willing to pay more results in more rental income, more rental income results in higher property values, higher property values result in more tax revenue, more tax revenue is available to cover the cost of servicing the debt on the infrastructure spending.

HERE’S THE THING ABOUT TENANTS

Tenants – whether they are office tenants, retail tenants, or apartment tenants – decide how much they are willing to pay in rent based on the value proposition today. They aren’t in the business of speculating on future value (in this case, future value of future transit accessibility) because they won’t have a property interest or ability to benefit from the change to circumstances when it occurs. There is no bonus associated with having previously rented in an area that has since changed.

For a typical office tenant with, say, a 10-year lease, the thought process would be this: we’ll pay for the value of the location today, and maybe assign a discounted value to the changes that we know about (e.g., the value of an infrastructure project that is currently under construction), but we aren’t paying for value that we may never see. For a residential tenant, the timeframe is even shorter. This explains why rents in White Flint, on a per square foot basis, are a lot closer to the rents in Wheaton than they are to the rents in downtown Bethesda. Sure, there is a lot of new development planned for White Flint, but right now there aren’t a lot of amenities outside of Pike & Rose, and the extent to which you value the amenities at Pike & Rose depends on whether you need to walk or cross the Pike to get there because the pedestrian environment is hostile.

AMENITIES THAT ADD VALUE TO THE PROJECT VERSUS PUBLIC BENEFITS THAT ADD VALUE TO THE COMMUNITY

At this point it is worth pausing for a moment to address a key distinction: the distinction between amenities that add value to the project, and public benefits that are required and which generally constitute what economists call a “tax.”

First, some of the amenities that are required via the zoning approval process are similar to the sorts of amenities that a developer might be willing to provide anyway (for example, mid-block connections are something that can be required for projects that want to take advantage of “bonus density” through the CR zones, but also create a lot of valuable street frontage in a mixed-use retail environment). The reason that the developer might provide them anyway is that the amenity increases demand for the project, or the rent price points that the market will support.

On the other hand, some public benefits do not add any value to the project itself and therefore represent a cost on one side of the ledger with no rent/price benefit on the other side. These tend to be public benefits that, in purely economic terms, constitute a tax. For example, inclusionary zoning and agricultural land preservation are examples of costs to downcounty development for the purpose of addressing a countywide problem. These types of public benefits can be costly – e.g., requiring 12.5% to 15% of residential units to be affordable for the next 99 years – but don’t do anything to add to the rents achievable in the market rate units.

I don’t raise the issue for the purpose of arguing against these requirements – these are complex issues and there is plenty to discuss about those policies – but simply to point out that the costs of complying with these requirements can make an already challenging project even more challenging without doing anything to add to the value of the project or return on equity. If the community wants an area to redevelop, and to redevelop in a way that includes a lot of amenities and infrastructure, one potential obstacle to that redevelopment is the cost of these public benefit taxes that the real estate industry is required to bear so that the public can achieve societal goals.

TIMING ISSUES

Large-scale suburban redevelopment projects typically face a key challenge: the costs are heavily frontloaded, and the income is heavily backloaded. The costs are frontloaded for multiple reasons, but the primary ones are these:

- Sitework for a large site is significantly more expensive than it is in smaller, single building developments.

- Infrastructure, such as internal public and private streets, is expensive and generally needs to be built early in the project.

- The community’s expectation is that public benefits and amenities will be provided early in the project.

These factors are evident in looking at sketch plans proposed and approved – infrastructure and amenities are frontloaded for most multi-building, multi-phase, mixed-use projects.

Of course, this also means that the amount of money spent at the start of each project is large and that means that “getting into the black” is an even steeper climb than it would be in a smaller, simpler project. And the developer in such cases can only go so far “in the red” because the project needs to be able to recover those up-front costs and generate an acceptable return for investors relatively quickly – if that seems unlikely, then the project won’t be financed at all.

TIME VALUE OF AMENITIES AND INFRASTRUCTURE

The community places a high value on the amenities/public benefits – those amenities are often missing, and the prospect of getting those amenities/public benefits is the reason why the community supports the project. And the community often fears the impact that new development will have on the capacity of existing infrastructure – sometimes with good reason.

At the same time, the developer is usually hoping to try to spread these up-front costs across as many units or revenue-generating square feet as possible. An amenity that might make sense to provide with the 4th apartment building in a multi-phase project is harder to justify when you haven’t even started the 1st apartment building. This disconnect is related to our topic for next week: the different “time values of money” that the public sector and private sector have and how that affects redevelopment strategies.

Wrapping up

When the planning problem in an area is that the area is undesirable as a location for investment and development activity, there is usually a reason. Correctly identifying that reason is one of the key functions of the master planner. But it can’t stop there – the public and private sectors need to be rowing together otherwise the problem will persist. This means developers providing highly-amenitized projects, and it means the public sector creating an environment in which those highly-amenitized projects can succeed.

To do that, the public sector needs to use all the tools at its disposal – reduced taxes (including public benefits that don’t create value that accrues to the project), selective use of incentives, small but critical infrastructure projects such as those that increase connectivity between new developments, and transformative infrastructure investments that alter the trajectory of the neighborhood.

When the public sector does make those investments, the flywheel starts turning. The area becomes more attractive to tenants, the tenants are willing to pay more in rent, the higher rents result in assessment increases for commercial properties, the higher assessments lead to higher property tax revenue, and the increased property tax revenue covers the cost of servicing the debt on the public sector investments. And from there, neighboring properties often redevelop in turn because, hey, who wouldn’t want to be next door to that?!