Real estate market analyses address the following questions:

- Is there demand for renting or buying the proposed project?

- Given competitive supply:

- How quickly will the project be absorbed by the market?

- At what rent/price point?

- How should the project be positioned in the market?

A good market study is really a synthesis of supply and demand studies. We’re really going to focus on the demand side of the equation for now, but supply will get its close-up as well.

For most real estate product types, the key drivers of demand are going to be a combination of demographic growth (population, households), employment growth (at-place jobs, resident jobs), income and value-added growth (personal income, wages and salaries, GDP). Sometimes there is unserved/underserved “latent” demand, but we’ll leave that for now. So, let’s just understand that from a demand perspective, if there isn’t a bunch of latent demand, then you need some combination of those demand factors to generate demand for the product in the submarket. Sure, there are real estate products that have different sets of demand drivers, but usually it is all about some combo of people, jobs, and money.

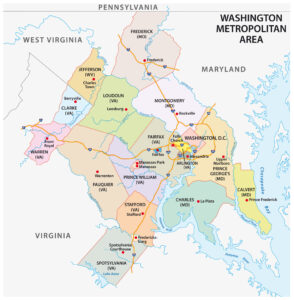

For office uses, demand is primarily about employment growth. Usually, recent employment growth helps drive assumptions about future employment growth, and future employment growth and current & future space per employee trends then drive the projections for office demand. All of this gets checked against other factors like recent capture rates and absorption trends, but the basics are simple. So let’s review the big demand problem facing MoCo – it really is pretty simple, the people who are interpreting office market studies view the fact that very little new office development has occurred in MoCo as a sign that there really isn’t much demand for office space in MoCo. Shocking or revelatory? Not really. Straightforward? Yes, absolutely.

MoCo office demand factors are driving very, very slowly

If this topic were the Beltway, MoCo would be the car going dangerously slowly in a middle lane, the one that you really want (nay, need) to pass. C’mon, already!

Total employment for the region is up by 284,000 for the decade (↑7.20%), while total employment for MoCo is up less than 15,000 (↑2.21%). Looked at a different way, MoCo was home to about 1/6th of the jobs in the region in 2011 (16.81%) but MoCo has captured only about 1/20th of the additional jobs since 2011 (5.17%). So, the capture rate for MoCo is a lot lower than it was a decade ago. But that obscures a key fact, and that is that MoCo jobs working for others (wage and salary jobs) are actually disappearing.

Wage and salary employment for the D.C. Metro Region increased by a total of 115,000 (↑3.63%) from 2011 to 2020. In contrast, wage and salary employment in Montgomery County actually fell by 6,041 (↓1.23%). So, the region is adding wage and salary jobs at a rate of about 12,750 per year. Meanwhile, MoCo lost wage and salary employment at a rate of about 675 jobs per year. Again, MoCo was about 1/6th of the region’s wage and salary employment in 2011 (15.51%), but since that time MoCo actually has a negative capture rate (-5.26%). So the region is cannibalizing MoCo’s jobs, and adding others from outside the region or from growth in the industries.

As I have noted in these pages, and in my presentations, conversations, and basically everything I have written in 2021…the long, slow erosion of the commercial base is but a happy memory, because the County’s economic decline is really picking up speed. The 5-year change from 2015 to 2020 tells a pretty clear story that should be a wakeup call for folks who still don’t quite get it…wage and salary employment for the entire region is down 14,286 over that five-year period which is actually LESS THAN the decline for MoCo alone (down 17,942 from 2015 levels). So, even after the awful pandemic-related job losses of 2020, the rest of the region was up 3,656 jobs for the decade, but Montgomery County pulled the region down into deeply negative territory. That’s right folks – MoCo is responsible for 126% of the region’s wage and salary job losses over the past 5 years. This is not a regional economic problem; rather, it is a local economic problem.

MoCo office demand low even with rock bottom prices

What we are describing here is a very real absence of demand. The market is making clear that there just aren’t very many tenants that want or need to be in Montgomery County. Overall, the metro region has seen about 41.4 million square feet of new Class A office space built since 2010, bot only 4.4 million square feet of that is in MoCo (10.6%). And that is in spite of the fact that prices are substantially lower in MoCo – e.g., rents in Class A office space built since 2010 average $41.12/sf in MoCo, but rents in Class A built since 2010 in the rest of the region average $53.99/sf.

There are multiple ways to compare office prices and demand levels, but there really isn’t a way to do so that doesn’t lead to the same inescapable conclusion: the County is not competing, even though rents in MoCo new construction are 1/4 below the rents in new product elsewhere across the region.

It is worth keeping in mind that real estate investment decisions are being made on the basis of not just costs, like the property tax, but based on the net between revenue and costs. Leaving aside for a moment the cost issue (one element of which – taxes – was covered in greater detail last week), there just isn’t much money to be made in MoCo because there simply are not very many firms that want or need to be here even though the real estate products they are looking for are often cheaper in MoCo.

Incentives are part of the solution

One thing the County can do – and that I have recommended – is further reducing those costs by offering both an incentive for firms that pay high wages and salaries, and an incentive that covers a portion of the real estate cost associated with occupying new space. Maybe it moves the needle a lot or maybe it moves the needle a little, but it is absolutely worth seeing how elastic demand is at the margins. If we are able to make choosing MoCo make sense, do some additional projects get built or do some additional tenants decide to locate here? We’ll see, but I’m going to go guess that it will. And, as I have previously and elsewhere noted, there is a self-reinforcing aspect of this problem that needs to be addressed here also – the reality is that we primarily have a demand problem that is affecting supply, but we also have a problem of relatively little active pipeline of new supply limiting the options even for tenants who otherwise be inclined to give MoCo a decent chance of competing for their business and investment.

Looking at resident employment numbers makes clear why all of this is important. The gap between peak 2019 employment and current resident employment numbers is about 35,000, and the gap between 2019 trough unemployment and current unemployment is about 12,000 (23,000 MoCo residents who were in the workforce pre-pandemic have simply left the laborforce). Put differently, there are 35,000 fewer working MoCo residents than two years ago, and 12,000 more MoCo residents who are out of work and looking.

But looking at the BLS’ Quarterly Census of Employment and Wages (which gives us the most current good count of MoCo at-place employment), illustrates the problem facing policymakers who are serious about addressing those resident employment and unemployment numbers: 2Q 2021 employment in the County in professional and business services is more than 5,500 below its 2Q2019 levels. It is hard to feel good about our progress against resident unemployment when the County’s LARGEST industry is actually shrinking. So, there are not a lot of accessible options for those MoCo residents who would like to find employment or jump back into the job market.

A big problem for those unemployed MoCo residents is that there simply are not enough employers relocating to – or expanding in – Montgomery County. And that creates a deficit of opportunity and prosperity that every policymaker should be serious about addressing. That need not be a political problem, and nor is it incompatible with spending more on transit or fixing procurement system problems. But it is a separate problem, and it is a problem that deserves a lot of focused attention. I certainly hope that elected officials and those who hope to hold those positions are able to understand that this is a problem that needs to be addressed, even if only to generate the revenue that is necessary to provide the services, or the compensation increases, that many county residents and employees need or have come to expect.

I’ll be back soon with a look at the 2020 GDP numbers that will be released this week, as well as a review of 2020’s most important and relevant articles in the economic literature. In the meantime, be well, stay safe, and shop MoCo!!!