In this third MoCo Economy Watch blogpost, we check in on some new employment numbers. What we find is that in early 2021 the number of unemployed County residents did not change much, but labor force participation increased. Both of these ran counter to the statewide trends during the same time period, which featured falling numbers of unemployed and stubborn labor force participation numbers. Furthermore, we check back in on employment in some important industries in late 2020. We find that Montgomery County had a better 4th quarter than expected, though not in a way that would change our understanding of the longer-term trends.

April unemployment numbers are a mixed bag

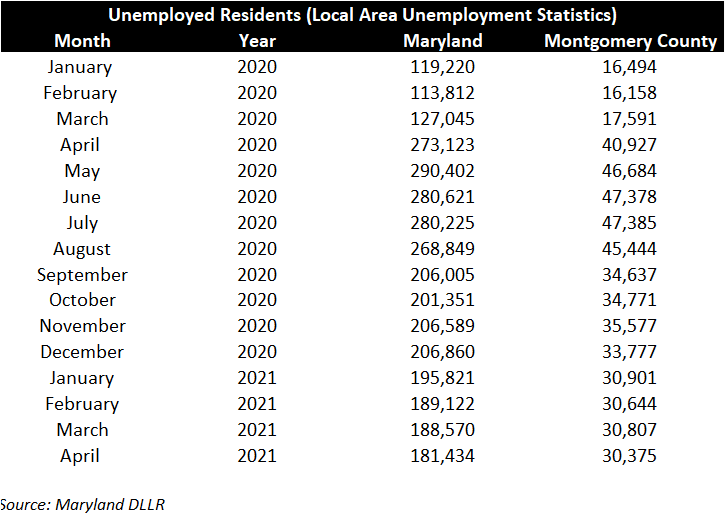

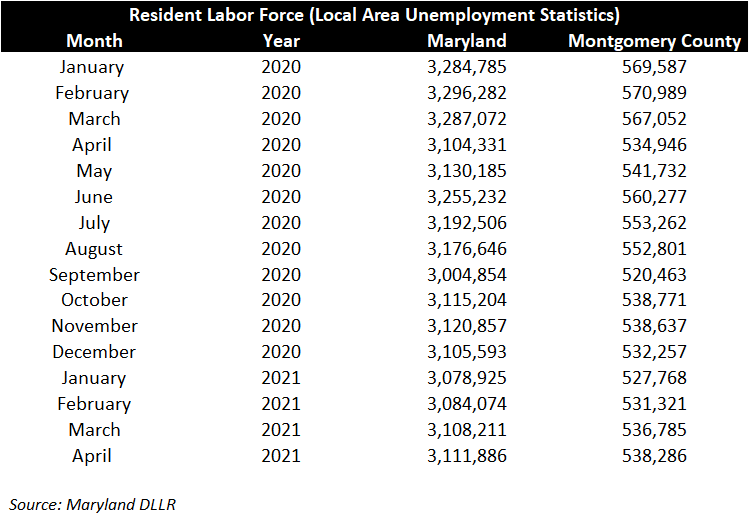

The most recent local area unemployment statistics cover April 2021 and they are a mixed bag. The unemployment rate edged down, and while the number of unemployed fell only slightly, the number of residents in the labor force increased for the third consecutive month. Let’s dig in.

With respect to the rate, Montgomery County’s unemployment rate pre-pandemic was 2.8% in February 2020 (3.5% for Maryland as a whole). It rose to a peak of 8.6% in May of 2020, a mark it reached again in July. The newest release shows that the April unemployment rate was 5.6%, down from 5.7% in March. This was the 5th consecutive monthly decline, and at this point both Montgomery County and Maryland, with a statewide unemployment rate of 5.8%, are 3% below their pandemic peaks.

These numbers are encouraging on the one hand (yay, lower number of unemployed residents and lower unemployment rate overall!), and also a little discouraging because Montgomery County’s overall numbers have not changed as much as the Maryland numbers. For example, the number of unemployed County residents dropped by only 526 from January through April, while the number of unemployed state residents fell by 14,387. Any time Montgomery County is only 3.7% of anything in Maryland’s economy it is a red flag.

On the other hand, the number of County residents in the labor force grew for the fourth consecutive month. During that time, the labor force in Montgomery County has increased by 2.0% compared to only 1.1% for statewide. While Montgomery County’s labor force is still 32,703 below its February 2020 peak, it is now 10,518 above its January 2021 level. That is a lot of people who hadn’t even been looking for work at the beginning of the year! Perhaps most interesting, Montgomery County represents 31.9% of the state’s return to the workforce. As was the case in discussing the small drop in unemployed, anytime Montgomery County is one-third of anything in the Maryland economy it is notable because we aren’t one third of the Maryland economy.

Why is it that Montgomery County represents such a small share of the drop in unemployment, and such a large share of Maryland’s recent increases in the labor force? To be clear, the answer is “I don’t know.” That said, demographics and automation are a couple of potential vectors to keep an eye on.

- Why automation? Well, when times get tough the response by employers is often to roll out productivity improvements. And when labor costs are high and there is a recession, well then there really are reasons to automate. When we start to get industry-level data for Spring 2021 we’ll have a better sense, but it could be that some of the jobs lost in industries like fast food will go away for ever and the places where that is likely to happen first are places like Montgomery County, where the cost of labor is much higher. The uneven effect of automation on labor is a topic that fascinates me, and I think it is one that will have an impact on low-wage jobs in high labor cost geographies.

- Why demographics? One variable I’d like to keep an eye on is age. A characteristic of major shifts in the economy is older workers having trouble finding re-employment, and many them eventually leave the workforce for good. If that isn’t happening in Montgomery County, then that could explain some of the rebound in labor force numbers. Another thing I’d like to keep an eye on is gender. It has been well documented that a lot of women left the labor force during the COVID-19 recession. It will be interesting to see how much of the return to the labor force is tied to older workers (Montgomery County’s skew more educated and therefore more re-employable) and women (who may have left the labor force while schools were remote, but many/most/all of whom belong to households that can’t really afford to live in the DC region without their income).

4th quarter 2020 industry-level employment news is…also a mixed bag?

As I discussed a couple of weeks ago, June 7th was the release date for 4th quarter numbers from the Bureau of Labor Statistics’ Quarterly Census of Wages and Employment. This is the best County and industry level data that we get, so even though we’re looking 6 months back in the rear-view mirror, it is worth pausing to review the latest.

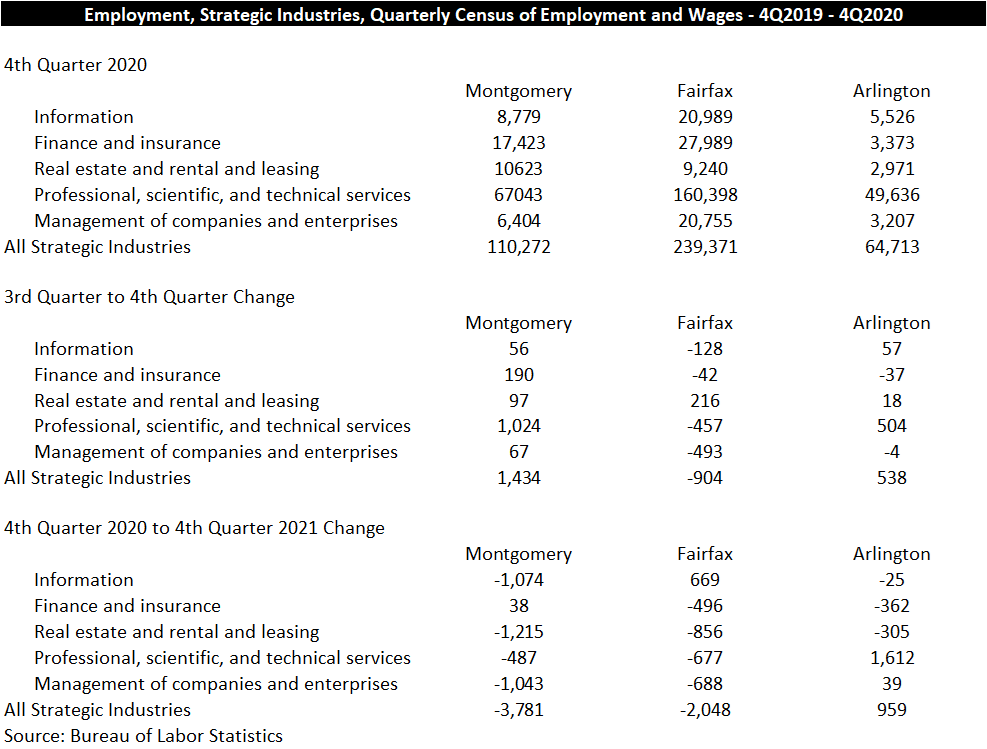

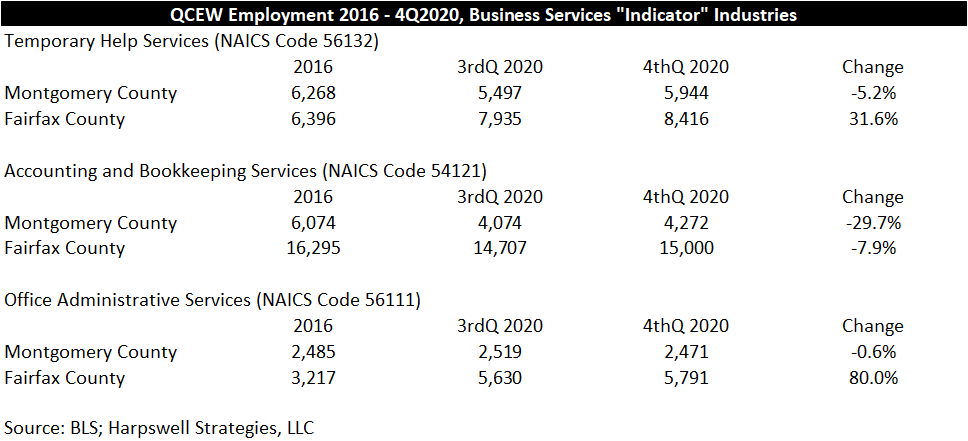

We had discussed a basket of industries that I call our “strategic industries,” in which Montgomery County had really underperformed neighboring Fairfax County and Arlington over the entire decade from 2010 to 2019. At that time, we touched on QCEW numbers that indicated continuing – and possibly accelerating – weakness in those industries, with the County experiencing a 4.6% decline (5,200 jobs) in employment over the 4 quarters that ended with the 3rd quarter of 2020.

Recognizing that there can be some noise in the numbers for any specific quarter, I was eager to see whether the 4th quarter data support the notion that the declines in 2020 were separate from the pandemic recession. This was of particular interest not only because these are the high-wage industries that drive investment and growth in the County, but also because these are among the industries in which employment numbers should have been least affected by the pandemic.

The 4th quarter numbers for Montgomery County were surprisingly strong, with the County gaining 1,400 jobs in these industries. That said, looking at the big picture the County is still down by nearly 3,800 jobs in these industries over the last 5 quarters while Fairfax County and Arlington combined are down only 1,100 in these industries over the period from late 2019 through the end of 2020. So, a good quarter, but after a rough year and a rough decade for these industries in Montgomery County, probably not enough to say that things are “looking up” overall.

We had also previously noted the steady performance of manufacturing in the County and…lo and behold, it held steady. Quarter-over-quarter, employment in manufacturing increased from 12,753 in the 3rd month of the 3rd quarter to 12,961 in the 3rd month of the 4th quarter for an increase of 208 jobs. This too is something of a mixed bag – obviously, positive that the County gained a couple hundred jobs in the industry late last year, but disappointing insofar as there is little sign of growth in the industry that is big enough to offset losses elsewhere in the economy. For example, Pharmaceutical and medicine manufacturing (NAICS 32541) grew by only a few dozen employees.

Finally, I’ve been keeping an eye on some industries that I sometimes refer to as “the jobs that follow the jobs.” With respect to these industries, the 4th quarter was better than the 3rd, though Fairfax still outgained Montgomery in those industries (↑935 in Fairfax, ↑597 in Montgomery County.

I think what we’re seeing in these numbers here are some good signs…but given the longer-term trends, we’re going to have to keep an eye on these industries to separate the signal from the noise.

Wait, what does it all mean?

Montgomery County had a stronger 4th quarter than expected in some important industries, but the geographic center of the region’s economy continues to shift to the west. The spring unemployment numbers paint a picture of a tepid recovery, though hopefully those who are re-entering the labor force will be able to fill some of the jobs that employers are having trouble filling. If so, that could really provide a boost to the County’s economy for the rest of 2021.

I’ll be back soon with more on Montgomery County’s economy. I’ve been deep in some personal consumption expenditure numbers recently, so we’ll probably be taking a look soon at issues like household saving, spending, and the retail landscape in Montgomery County. But, as someone who never stops thinking about the County’s economy, there are a lot of topics that I want to cover…