This month, we look at the current state of the Mo Co Class A multi-tenant office market (horrible!), explore how deep a local recession could be (really deep!), take a look at some recent-vintage personal consumption data for Maryland (lagging!), touch briefly on the Council’s approval of Thrive 2050 (let’s move on, people!), and review the key takeaways from a recent analysis of St. Paul’s rent control program (it is failing to achieve anything that people want it to achieve). Let’s dig in…

HEADLINE NUMBERS

Over the past 4 years, occupied space in Mo Co’s Class A multi-tenant office market has declined by more than 1.7 million square feet. At 195 square feet per job, this is equivalent to the amount of space that would normally host more than 8,700 jobs (195 SF/job is based on the number of net new square feet and net new office jobs over the 8-year period prior to the pandemic).

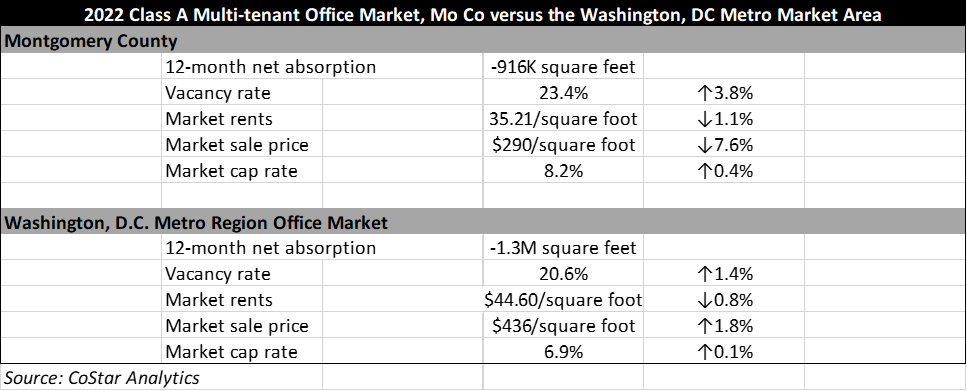

Mo Co represents about 1/7th of the region’s Class A multi-tenant office space. Here is how it compares to the region as a whole (including Mo Co):

So, about 75% of the region’s negative net absorption is in Mo Co. Looking at the vacancy rate, market rent, market cap rate, and market sale price data you can see what “flight to quality” looks like…and it looks a lot like “Escape from Montgomery County,” the less known and less exciting sequel to “Escape from New York.” Moving on…

HOW LOW CAN IT GO?

Earlier this month, we released the first part of our recession coverage, which looked at how recessions are defined and considered whether current local economic conditions might constitute a recession. Subsequently, we released the second part of our recession coverage, which recounted some of the history of the Great Recession and we examined the “slow burn” from peak of the housing market to the lows of economy and the subsequent lengthy period of depressed economic and revenue growth in the County.

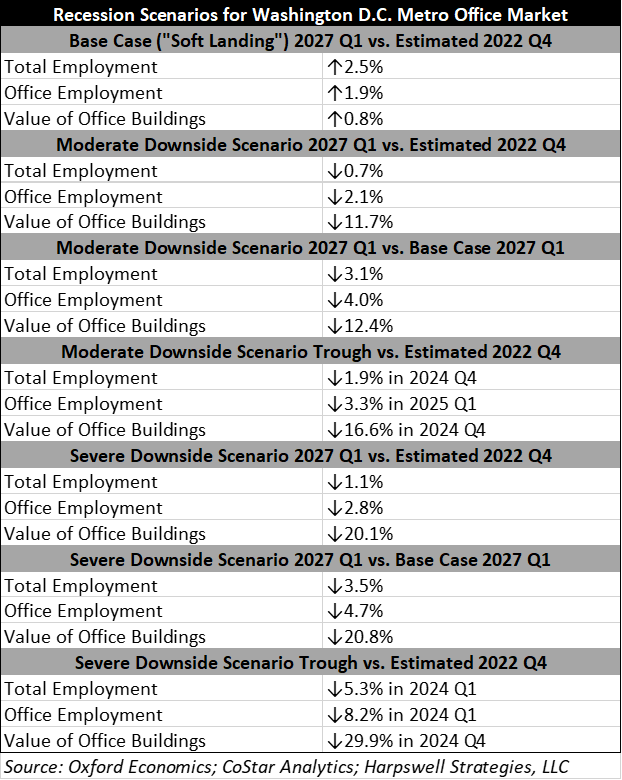

Out of curiosity, I thought I’d check in on some specific recession scenarios and what those might mean for the area economy. To do that, I used two macroeconomic forecast scenarios produced by Oxford Economics (moderate downside and severe downside) and compared those to the current state of the regional economy and to CoStar’s “base case” for the forecast horizon, which is 2027 Q1.

The “base case” assumes that the values of office properties will decline by 3.1% before ultimately landing at 0.8% above current levels in the first quarter of 2027 (the forecast horizon). Employment will drop a little over the next year and will rise modestly in beginning in 2024. In this scenario the likely outcomes for Mo Co would include basically zero growth in the office component of the assessable base and in office employment, with some modest growth in non-office employment. So, this is a “soft landing” scenario.

In terms of the tax base, its worth pointing out that this would mean that residential property taxes and resident income taxes would then need to be the source of funding for county provided services, and it would be the household sector that would be on the hook for increases in compensation and benefit costs (combined, comp and benefits represent about 80% of the total tax supported operating budgets). And it is worth pointing out that if employment isn’t growing, then it isn’t clear who would be moving to the region or whether they will have much taxable income.

In the “moderate downside scenario,” the region hits bottom in late 2024 and early 2025 with total employment at 1.9% below current levels and with office buildings across the region losing 16.6% of their value. The numbers bounce back somewhat over the remainder of the forecast horizon; in this scenario, at the end of the 1st quarter of 2027, office buildings will be worth 12.4% less than they would be in the base case, and total employment would fall short of the base case by 3.1%. In the “severe downside scenario,” the decline is steeper and arrives sooner – by early 2024, total employment declines by 5.3%, office employment declines by 8.2%. Remarkably, by the end of that year office buildings lose 29.9% of their current value. While there is something of a “dead cat bounce” in 2025 and 2026, employment impacts are substantial (down 3.5%) when compared to the base case. In this scenario, the value of office buildings in 2027 Q1 will be more than 20% below where those values would be at that time under the “base case.”

There is a non-zero chance that tens of thousands of the region’s residents lose their jobs and office buildings lose an eighth or more of their value over the next 4+ years. It is worth keeping these numbers in mind as new data points start rolling in…

OMG, PCE!

For the U.S., personal consumption expenditures increased by 12.7% in 2021. Within the region, that varied from a low of 10.6% in D.C., to a high of 12.8% in Virginia. In Maryland, PCE increased by 11.3%.

Just looking back at the last 5 years, it is evident that per capita spending by Marylanders is lagging behind spending in the rest of the nation. Overall, the compound average annual growth rate of PCE per capita for U.S. residents is 4.3%; however, Maryland PCE per capita increased by only 3.0% per year during this time. Those differences were broadly evident – U.S. spending grew faster than Maryland spending on durable goods (↑9.7% per year, versus ↑8.7% per year in Maryland), nondurable goods (↑5.2% per year, versus ↑4.9% per year in Maryland), and services (↑3.1% per year, versus 1.6% per year in Maryland). Within the broader category of “services”, per capita spending by U.S. residents on “housing and utilities” increased by an average of 3.7% per year over the last 5 years, compared to just 2.7% per year for Marylanders.

Since personal consumption accounts for roughly 70% of U.S. GDP, the fact that Mo Co PCE is lagging behind PCE elsewhere in the region is a reasonable indicator that GDP will also lag. Preliminary 2021 GDP numbers for counties will be released on December 8th.

THRIVE 2050

Too much has already been said on the subject, so I won’t go into much detail here. That said, the Council unanimously passed Thrive 2050, an update to the General Plan. There is a lot in the plan that is good, and certainly enough to outweigh my concerns about specific aspects of the plan. What I did want to note is this: lost in all the noise about the “controversial plan” and the “scandals at the Planning Board” is this: this plan was very popular despite the strength and insistence of the opposition.

This June piece in Maryland Matters highlighted the strength of the plan’s support among Mo Co democrats, based on an independent poll of Mo Co democratic primary voters:

By better than two to one, voters approved of a push to alter the county’s growth plan to allow for different types of housing. “Thrive Montgomery 2050,” described as “update to the county’s master plan” that “would also open up some single-family neighborhoods to a mix of housing types, such as duplexes and triplexes, but would not change zoning or other detailed land use,” had the support of 55% of those surveyed; 21% were opposed.

Support was strongest among unmarried voters, renters, Blacks and those under 45.

If more than 70% of Mo Co democrats who had formed opinions on Thrive supported it (55%/(55%+21%)=72.4%), then the policy document that the Council passed seems like a pretty good reflection of where the community stands on the issues. There is no end to the number of different land use battles that can and will be fought in Mo Co, but it is nice to know that we can (finally!) put this one behind us.

RENT CONTROL

My mother is fond of saying “I need (blank) like I need a hole in my head.” That phrase comes to mind whenever I think about Mo Co and rent control. Mo Co already has an extensive inclusionary zoning program (which is basically 99 years of rent control for a portion of all new units built), it is well established that disinvestment is Mo Co’s problem rather than gentrification, and the County is literally an economic anvil pulling the rest of the region down with it…so we need this why again? And where is the money going to come from to pay for the services that county taxpayers need if there is no commercial growth and if we further limit the tax potential of the residential base?

This recent NBER research paper is a good read for those who are interested in the topic and well caffeinated. The authors find: St. Paul’s recent rent control law has caused a 6% to 7% decline in property values; that the program’s benefits flow mostly to white tenants and wealthier tenants; that the owners most negatively affected tend to be minorities; and that, for properties owned by wealthier owners and rented by lower-income tenants, the amount of wealth transferred was close to zero.

But other than that, Mrs. Lincoln, how was the play?

WRAPPING UP

Just indulge me for a moment as I acknowledge a few of the other folks who produce relevant content with a hyper-local focus.

- Adam Pagnucco recently launched Montgomery Perspective, adding newsworthy short-form content on an almost daily basis. It is a fantastic newsletter and adds a great deal to the ecosystem. Obviously, Bethesda Beat does great work providing daily news as well. High frequency local news coverage is something that no one should take for granted, both because it is so rare and because it is so important to functioning democracies.

- Sunil Dasgupta’s podcast, I Hate Politics, is a regular deep-dive on issues relevant to the local political landscape. I really valued his interviews with candidates for office this year. Long form interviews are an important piece of the puzzle, and too often those “intimate” longer discussions can turn into fawning and fluff – no fawning or fluff is allowed on IHP.

- Jim Troy’s Montgomery Newsletter is a subscription that you should have if you are following the real estate markets. He does an excellent job summarizing recent land sale and homebuilding activities, commercial real estate, Council and Planning Board actions on relevant planning and policy issues, and more.

Hang in there, folks.