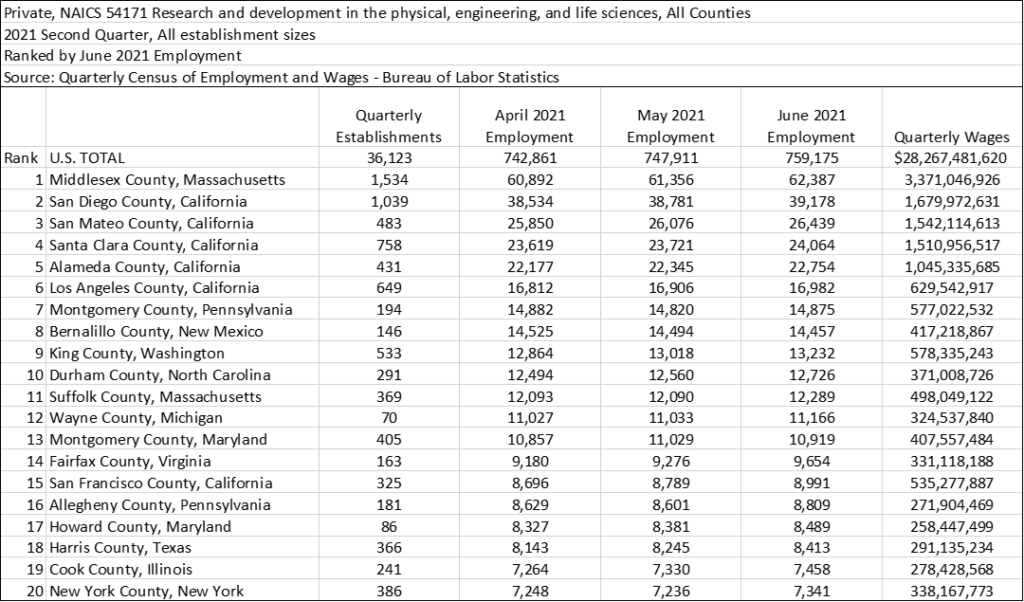

There are more than 3,000 counties in the U.S., but the jobs in private sector R & D (NAICS 54171 – Research and development in the physical, engineering, and life sciences) are concentrated in a small number of them. To illustrate, the top 20 counties (ranked by June 2021 employment below) account for 45% of U.S. employment and 54% of U.S. wages in the industry.

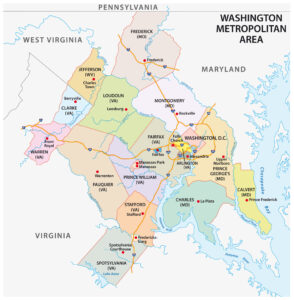

Montgomery County is ranked #13 nationally and #2 among the nation’s Montgomery Counties, for those of you who are keeping score at home. Montgomery County does have the most employment in the industry among D.C. area jurisdictions – ranking just ahead of Fairfax County, Virginia and Howard County, Maryland. And during the second quarter of 2021, MoCo gained 62 jobs in the industry out of about 16,500 nationally – small sample size and all that, but it is good to have some perspective about the recent growth in jobs in a county whose bioscience area of expertise is vaccines.

Montgomery County has seen a healthy increase in the number of establishments in the industry, increasing by 31% over the 4.5 years from 2017 through the middle of 2021. Employment increased by a similarly impressive 32% during that time. But MoCo isn’t exactly setting the pace. For example, the U.S. total number of R & D establishments increased by 69% during that time, with employment increasing by 30%. Put differently, MoCo’s growth as measured by the number of establishments is below the national average, while from an employment perspective the County is slightly outpacing the nation as a whole. Again, the industry is very concentrated, so this is not at all the same thing as the median growth rate for all counties, which is probably much lower. But it is notable that we are gaining very little of the “national market share” in this industry.

Just looking at the behemoth here, Middlesex County (MA) is really eating up a lot of the nation’s growth, with the number of establishments increasing by 55% from 2017 Q1 through 2021 Q2, and total employment increasing by a similarly astounding 56% during that same period of time. Moving just down the road to Suffolk County (MA), the number of R & D establishments has increased by 87% and employment has increased by 54% during that time. So, from an employment standpoint the Boston area is really gaining a lot of market share.

Similarly, the San Francisco Bay area is really doing well when it comes to R & D employment. San Francisco County (↑266%), San Mateo County (↑47%), Alameda County (↑47%), and Santa Clara County (↑36%) are all experiencing faster growth in R& D employment than MoCo. I guess its probably worth noting here that most people who know the Boston and San Francisco areas would probably rather live in either of them than in Suburban Maryland. I mean, what MoCo has in humidity both of those areas can match in terms of…natural beauty and weather, just to name two things…and no disrespect intended, folks. Given all of that, I thought it would be a good idea to take a high-level look at the lab inventory and real estate pipeline in these markets, just to get a sense of what is coming in the years ahead.

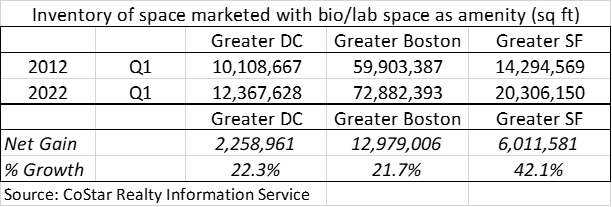

The DC area lab market is really small compared to the Boston area lab market, and the gap between DC and SF is only growing (I’m not even going to get into San Diego, Philly/NJ, and North Carolina – trying to keep it simple!). The amount of growth in the DC area lab market, roughly 2.25M square feet, is less than half of the net gains in the inventory of lab space in SF over the past decade. This matters for a couple of basic economic reasons: it reflects that there has been more demand in Boston and SF, and also that there is more supply of recent vintage space in those markets to meet any new demand.

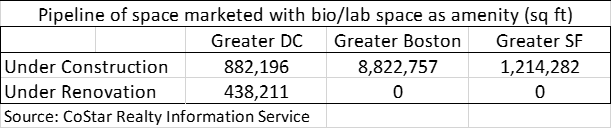

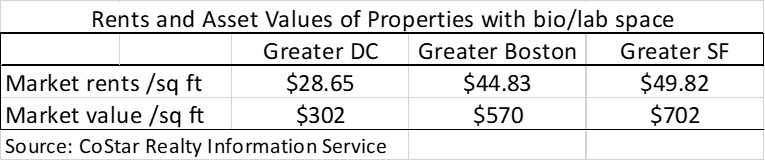

The key takeaway here is that the amount of lab space under construction in Greater Boston is 10x the amount under construction in the DMV. Given that bio is really having a moment right now, the jurisdictions that are best prepared with a healthy pipeline will be the ones that are best able to take advantage of any national or global momentum, industry growth, and capital flows. And as noted below, this is demand that is at price points that are waaaaaaaay above what we’re seeing in the DC region.

If price of land was driving any of this, then the DMV would be in great shape because the rents and capitalized values of real estate assets that include lab space in DC are, frankly, not in the same league as in the other two markets. Our current price-related advantages aren’t resulting in a lot of growth. While I’ve previously discussed the idea of increasing that price advantage with generous incentives, there is another option – MoCo could simply right-size its aspirations for bioscience as an industry, for innovation as a driver of growth in the capital region, or for what it expects to get out of the land use process in order to meet growing revenue demands and a desire to meet so many social needs via the “magic of land use exactions” which is basically an off-the-books way to tax and spend without actually…taxing and spending.

zeroing in on some recent policy and political efforts

In spite of some recent progress, MoCo’s land use and development approval process remains complicated, lengthy, and fraught. In recognition of this, Councilmember Friedson introduced a Zoning Text Amendment, see ZTA 21-09 – Biohealth Priority Campus, which the Planning Board supported 5-0 with some suggested modifications; and a subdivision regulation amendment was also proposed – see SRA 21-02 – Biohealth Priority Campus. Both would apply to single tenant projects that are either: new construction biohealth projects of at least 150,000 square feet; or renovation biohealth projects of at least 50,000 square feet.

It is hard to argue against reducing development approval process times, and I think the initiative is on the right track. Ben Wu, CEO of the Montgomery County Economic Development Corporation, put it well when he summarized the potential benefits in his testimony on the ZTA: “Passage of ZTA-21-09 will be a win for the county in multiple ways. One, it will attract the full spectrum of life sciences from research and development through manufacturing and distribution. Two, the companies at stake will make very large capital investments with custom built facilities that expand the tax base, providing high-paying jobs and drawing top talent. These gains will contribute mightily to the local economy.” Amen, Ben.

But, in classic fashion, some of the political and policymaking energy associated with this discussion has been diverted to discussing an amendment to the bill that would require such projects to negotiate community benefit agreements. All of this begs some questions, including the following:

- Is it possible to just simply address the issue of reducing approval times without also addressing tangentially related historical inequality? Is it possible to debate reducing approval times for a biohealth priority campus as an end in and of itself? And if not, what does that say about the County’s chances of finding its way out of this mess?

- Why offset reduced process risks/costs by introducing new process risks/costs? And why do that as a quid pro quo in the context of legislation that is designed to reduce that process risk/cost?

- And what about our land use and development market supports the notion that there is excess residual value there that the County or community can extract via legislation or negotiation?

As part of this debate, the Council is now considering a resolution (action was postponed today, so stay tuned…) to create a fund to support incentives for such projects when they are in an opportunity zone and increase the potential awards under the County’s MOVE program…which is odd given that the MOVE program is set up for small grants to small tenants with a previous maximum grant of $80,000, and in order to be a Biohealth Priority Campus a project has to be…um, a single tenant project that is large enough to be a priority…The resolution would treble that incentive, increasing the maximum available to a biohealth priority campus locating in specific County geographies to $240,000.

So, here are some more questions to consider:

- Why try to incentivize these projects to locate in specific geographic areas when we aren’t even particularly successful getting them to locate in the County at all? To funnel potential development to those communities there needs to be…enough potential development to funnel some of it to specific locations…

- Why bother to pass a resolution to increase incentives by small amount when the projects in question only happen with large incentives and/or free land? The amount of money that was being considered here was…absurdly small, given the recent and current market for incentives.

- Can anyone even identify the recent new construction projects that would qualify based on these standards? My guesses from the last decade are HHS on Fishers Lane and maybe the National Cancer Institute, and…IDK, I give up! In any event, both of those were built for public sector, public heath tenants…so we are trying to direct that market…why exactly?

Of course, it is good to try to encourage development in underdeveloped parts of the County. But for projects of that scale and nature, being eligible for an extra $160,000 in local incentives is simply not going to move the needle. For example, I think the Fishers Lane project (HHS) was initially approved for more than $19 million in incentives, or something like 120x the additional benefit that would be created by this Council resolution. So, the incentive resolution seems…tone-deaf…and feels like a performative act that is a (harmless) waste of time and effort.

Montgomery County’s land use politics are still based on a view of Montgomery County exceptionalism that is only held in a couple of government buildings in Rockville and a few minor organs of the body politic. And Montgomery County still struggles with the idea that economic development is separate from the politics of local development. So here we have it: an amendment to add procedural steps to a bill designed to reduce procedural risk for large public health related projects, and a new incentive that sounds good in a press release but won’t move the needle when it comes to developing the local economy. Good grief – save us from ourselves.