In this installment we zero in on the “macro” context by looking at the local competitive effects that are evident in the data. What we see is that national economic trends and national industry-level trends indicate that the County’s economy should be a lot stronger than it is. The analysis confirms the thesis that the County’s economy is underachieving and indicates that the likely causes are local in nature. Let’s get started.

Overview of “constant share” and “shift share” analyses

Two analytical techniques that are frequently used by regional economic planners and economic development researchers are constant share and shift share analyses.

Constant share analyses assume that the local share of a larger economy (e.g., regional, state, national) will remain the same over time. A slightly different way of looking at this is to acknowledge that, mathematically speaking, this means that the local changes in the various components of the economy (e.g., manufacturing, retail, finance and insurance) should track those of the larger geography. This can be a helpful analytical step if you are, for example, looking ahead and trying to project future growth in a region where the economy does closely track that of a larger region. It can also be a helpful analytical step if you are looking backwards and trying to determine if the local economy has been tracking the economy of some larger geography or if it has diverged.

There is no need to belabor the point I have been making for the last two years – it has been well established here, there, and everywhere – the County’s economy is diverging from the region and the nation. But the following summary should help provide a sense of scale in terms of the high-level numbers.

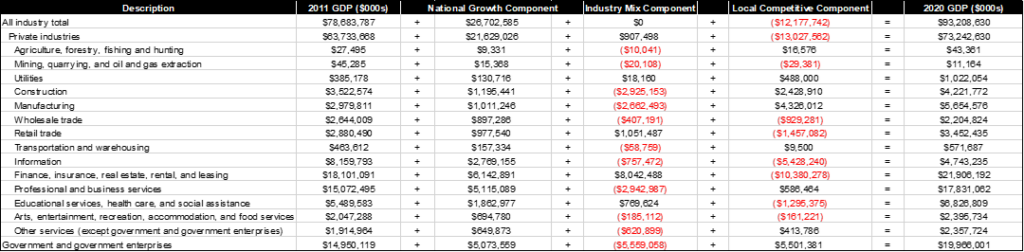

In 2011, MoCo represented 0.504% of U.S. gross domestic product. U.S. GDP grew by 33.9% from 2011 to 2020, meaning that if MoCo had maintained its share of the national economy, MoCo’s 2020 GDP would have been $105.4 billion, rather than actual 2020 GDP of $93.2 billion. This gap of $12.2 billion represents the extent to which MoCo’s fortunes diverged from the national fortunes over the past decade – 13.1%. Incidentally, those numbers look worse if you just focus on the private industry portion; MoCo private industry GDP is 17.8% below where it would be if it had grown at the same rate as national private industry GDP.

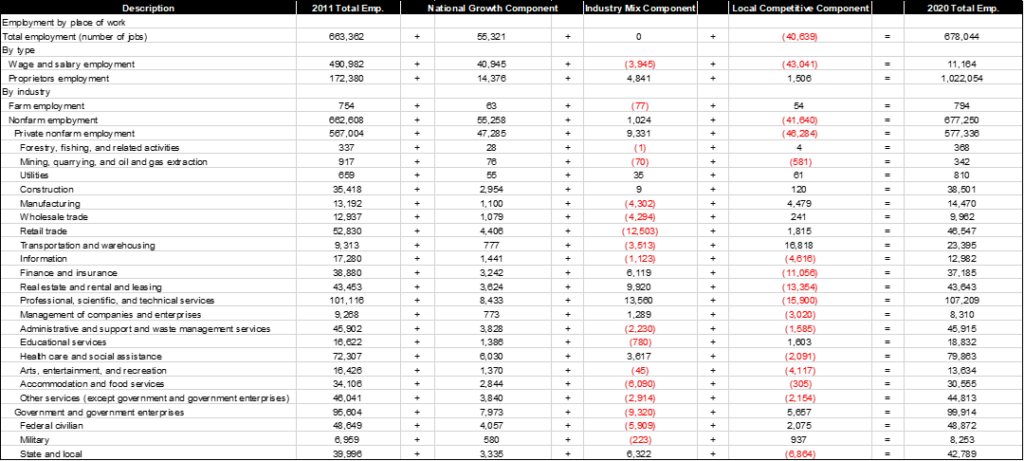

A similar trend can be seen on the employment side of the equation. In 2011, MoCo represented 0.377% of U.S. total employment. U.S. total employment grew by 8.3% from 2011 to 2020, meaning that if MoCo had maintained its share of national employment, MoCo’s 2020 total employment would have been 718,683, rather than actual MoCo total employment in 2020 of 678,044. This gap of 40,639 represents the extent of that divergence – 6.0%. Again, if we strip out the public sector trends and simply examine private industry total employment, the numbers look worse; MoCo private industry total employment fell 8.9% below the national trend line. (As an aside, it is worth noting the difference between the GDP and total employment divergence – the reason that the GDP decline is so much steeper is because the jobs that MoCo is losing are such high value jobs).

Shift share analyses are a useful tool in localities where the underlying trends have been or are expected to diverge from the those of the larger region. Specifically, shift share analyses help us to understand to what extent local competitive factors are (in the aggregate) affecting local economic performance, rather than say regional or national growth trends or industrial mix, i.e., the mix of industries in the local economy. Another way of putting it is that a shift-share analysis is one thing that people like me look at when we’re “grading on a curve” because it is a good way of isolating the degree to which a local economy is over- or under-performing.

What does a shift-share analysis tell us about the moco macro?

Unsurprisingly, a shift-share look at GDP tells us that MoCo is really punching below its weight when it comes to both wholesale and retail trade. More importantly, MoCo is also underperforming in some key “basic,” or export-oriented, industries: information; finance, insurance, real estate, rental and leasing services (FIRE); and education, health care, and social assistance. FIRE is where the data is most interesting because MoCo is declining so much despite some good tailwinds – in the table below, note the contrast between the national growth component and industry mix component on the one hand, and the local competitive component on the other.

The County’s economy is doing well when it comes to manufacturing, as well as government and government enterprises. Most of the strength in manufacturing is in non-durable goods manufacturing (food, medicine, etc.). We’ll get more into the public sector below, but it is worth noting that from the employment side almost all of the strength is military and state & local government, not federal civilian, and presumably it is state & local government that is driving a lot of the GDP growth.

Taking a look at the employment side, the picture is similar. Private nonfarm employment is punching below its weight, and so is wage and salary employment. But more to the point, the County has really bled when it comes to employment in the highest value-add and export-oriented industries – basically, the industries that we need to be successful and the industries in which most of the office tenants are found. The hemorrhaging is most obvious in the following: information; finance, insurance, and real estate; professional, scientific and technical; management of companies and enterprises; administrative and support; and health care and social assistance. The analysis also highlights some of the strengths and limitations of shift-share – “don’t try this at home” warnings are appropriate. For example, the County gained 223 federal civilian jobs over the past decade, which is not much of a return on investment for the County’s efforts in that regard. On the other hand, at least from the perspective of comparing MoCo to the national economy, MoCo did really well. Probably a more appropriate comp here is the regional economy (DC Metro or Maryland), and those comparisons would probably tell us more about how MoCo’s efforts to attract and retain federal civilian installations should be graded on the curve.

Wrapping up

Here are some high-level conclusions from all of this:

- A lot of the economic underperformance is related to the local competitive component. This could be caused by a variety of factors: the specific firms in each of these industries, not enough private sector investment in capital, taxes that are too high, increased competition within the D.C. region, etc.

- In general, the analysis supports the notion that substantial changes need to be made to shift the competitive landscape enough for MoCo to be effectively competing for high-value, office sector jobs.

- The County may be undervaluing some other industries in which it, frankly, fares well. Manufacturing is one that I have written about before. Educational technology and education services are another area of opportunity for MoCo.

- It may be that our assets are not as strong as we think they are. For example, health care services sector is not a particularly strong industry in spite of the presence of various federal agencies and a major military medical facility, an aging population, and very high levels of education.

Recently, I read through Bethesda Beat’s interviews with the candidates for County Executive, and 75% of the candidates clearly get that the economy needs to be an area of focus, while the other candidate seems a little more focused on grievances at this point, but maybe he’ll come around. Here’s what I’m looking for: Do they understand the problem? Do they have solutions that can be implemented locally? Are the solutions they propose just more of the same? Are they proposing meaningful or impactful solutions?

And frankly, it isn’t just about their economic development platforms either. Montgomery County’s economic development pitch for many years was great schools and low crime. That pitch isn’t really resonating with folks now. It is possible to improve the services that MoCo provides – including K-12 education and public safety – and doing so will make MoCo more attractive as a place to live, work, or invest. But to improve those services MoCo may need to choose to prioritize service levels rather than compensation for public employees, generally reinforce accountability for the quality of services provided, focus on meaningful governance rather than meaningless gestures…and do everything it can to support a growing and vibrant economy and support an abundance of opportunities for residents and businesses.

Finally, policymakers need to understand that tax policy isn’t just an outcome of all the spending decisions that the Executive and Council make each year; rather, it is an end in and of itself. Holding the line on local taxes, and reducing local taxes when possible, should be the goal…because right now two of the key suspects in the crime of the century (what killed MoCo’s economy?) are state and local taxes, which together are a lot higher than they are across the river. Let’s face it, high taxes are making it harder for the County to compete.

By the way, the next time I see a local elected official asking the state delegation to reduce Maryland tax burdens for the general MoCo taxpayer will be the first…so let’s just worry about the county for now. In a 2019 resident survey, 33% of County residents agreed with this statement: “I feel that I pay too much for the services I receive.” At the same time, only 12% agreed with this statement: “I am willing to pay more taxes to get more services.” So, you’d think, especially in this year of fiscal abundance, elected officials should focus on reducing taxes or holding the line rather than introducing new taxes or backing the county into a corner on expensive initiatives or compensation increases that will require future tax increases. We shall see.

We’ll be back soon. In the meantime, hang in there, folks. Be well, stay safe, and shop MoCo!